This article is the second of 5 articles in the ‘Building a winning forest impact investment strategy’ series.

Join The ForestLink’s newsletter so that you don’t miss an article, and register your interest for the exclusive ForestLink Impact Investment Seminar coming up this autumn.

Imagine that you are going on a grand adventure, with your dream destination somewhere out in the future. What if you had no idea how to get there? No googlemaps or navigation tools, no service stations along the way to stop and ask for directions. You have no idea how long the journey will take, what you need to prepare, how much money you will need, and come to think of it – how will you know when you’ve arrived? Embarking on a forest impact investing journey in the tropics can be a bit like this. You have a great vision for your strategy, the financial returns you expect to achieve, and the environmental and social benefits you will generate. But how do you increase your chances to arrive there, without having caused an inadvertent accident or two on the way, taking a very long detour, or arriving to find that your budget was way off. Mainstream investment approaches have been tried and tested, and though of course there are always unknowns – there are plenty of roadmaps and service stations along the way, as well as several experienced drivers (or managers) who have done the trip successfully numerous times, giving you confidence you will arrive at your final destination.

When we look at forest impact investments in the tropics, these are largely unchartered waters. There are few drivers, few service stations, few examples of those who have successfully made the trip. This article aims to build a roadmap of sorts, with various resources and tools that a forest impact investor can employ to increase their chances of success when building their strategy.

The makings of an impact investment roadmap

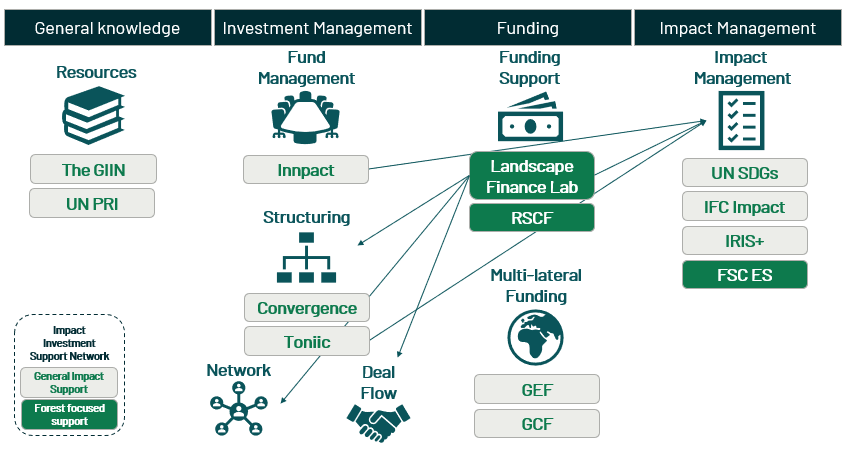

Before you head out, it’s advisable to visit a library to learn the ins and outs of impact investing. I have mentioned the Global Impact Investing Network (GIIN) in my last article, as having a robust definition of impact investing that I support. The GIIN is a non-profit, and produces an exhaustive resource library, conferences (once we can gather again) and other trainings. The UN PRI (UN Principles for Responsible Investment) has gathered practitioner expertise from around the world, and across various sectors/themes into their Impact Investing Market Map, which includes a focus on sustainable forestry and some alignment with the UN SDGs.

What specific support do you need – your service stations

Identifying the support you need to design and execute your impact investment strategy is critical to getting off on the right foot, and will save you time and money down the road. Generally, you can call upon experts in the fields of Impact Investment management, such as Innpact, an experienced impact finance advisor that also provides fund and impact management services. If you are seeking a community of like-minded impact investors, you might want to consider joining Toniic, where in addition to connecting to other impact investors, you can access their education platform, support with impact management, and deal flow. Convergence offers similar services, though with a focus on blended-finance vehicles, and directing capital to investments in developing geographies.

If you are looking for support that addresses your specific interests of forests and the tropics, you can draw from the Landscape Finance Lab – here you can get support with the scoping, structuring and design of your impact strategy, access innovative financing, shared learning and impact measurement tools. Keeping in mind, your program must have an impact focus on the landscape level. Similarly, if you are a new fund manager with an impact theme of forest landscape restoration, the Restoration Seed Capital Facility (RSCF), provides financial support through the early stages of fund development.

If what you envision for your impact strategy requires a lot of cross-sectoral engagement, reputational strength from its partners, and the establishment of extremely robust management frameworks, you may consider seeking support from multi-lateral mechanisms such as the Green Climate Fund (GCF), or the Global Environment Facility (GEF). These organizations traditionally focus their financing and support systems in the public-sphere, working with governments to improve the political frameworks and taking government action. However, they have both acknowledged the importance of the private sector in meeting global environmental and climate objectives and have thus developed financing mechanisms to support private sector engagement.

Managing impact – your traffic controller

So, you’ve now identified a support network that can help you get you from A to B in the design and execution of your forest impact investment strategy in the tropics, but you are still not clear on how to determine if you have met your objectives. The following are tools you can access to guiding your impact generating activities, provide a process to follow, and frameworks to consider signing on to.

Though the UN Sustainable Development Goals (SDGs) do not provide explicit management guidance for an impact investment strategy, they do provide a north star of sorts, providing a general direction of where to go. Forest impact investments in the tropics lend themselves to several of the UN SDGs, but particularly are well suited on the environmental side to #13 Climate Action and #15 Life on Land, and on the socioeconomic side to #8 Decent Work & Economic Growth, and #12 Responsible Consumption & Production. If you dig into the SDG targets and indicators, you can find very specific outcomes to help identify your impact key performance indicators. For example, under Goal 15, Target 15.2: By 2020, promote the implementation of sustainable management of all types of forests, halt deforestation, restore degraded forests and substantially increase afforestation and reforestation, and the indicator of Progress towards sustainable forest management, you would have a clear metric to work towards and evaluate success, such as your increasing area certified for sustainable forest management.

When looking toward impact management, a useful framework to consider is IFC’s Operating Principles for Impact Management. IFC has developed 9 principles that walk an investor through the investment lifecycle, from strategic intent, through origination and structuring, portfolio management, impact at exit and independent verification. If you like this approach, you can either sign on as a signatory to the principles, or choose to align your operations with them, without formally signing up. An additional management tool is the GIIN’s IRIS+, which is a widely accepted system for impact management, measurement, and optimization. It not only contains a catalogue of metrics, organized by impact theme, but also provides participating investors with impact management oversight guidance.

Though the above are excellent generalist support systems for impact management, when investing into nascent sectors like forest impact investment in the tropics, it is advised to acquire some industry specific support. In support of sustainable forest management in the tropics, I am always a proponent of the Forest Stewardship Council’s (FSC’s) robust forest management standard. Furthermore, when it comes to impact, in 2018, FSC developed a voluntary impact supplement to this standard, called the FSC Ecosystem Services Procedure (FSC ES). This procedure and its associated guidelines provide a clear, implementable framework for demonstrating and communicating the positive impacts of responsible forest management on ecosystem services, namely biodiversity, carbon, water, soil and recreation. Depending on your impact focus, and the underlying activities within your investment’s operations, other certification standards, such as carbon certification, organic farming or fair trade, could also provide you with a robust framework to support your impact management.

Reach out for support in designing your forest impact roadmap

Designing the roadmap to achieve your forest impact investment objectives in the tropics is a complex undertaking. If you need support on this journey, please reach out and we can discuss how to get you on the right path.