Today, at the World Forestry Congress (WFC) in Korea, a day has been devoted to the topic of sustainable investments in forests for people, profit and nature, and I am honored to sit on a panel with WWF New Generation Plantations (NGP), titled: Screening in: Advancing people-centred, pro-nature, profitable & inclusive forest projects – Lessons Learned. The session will draw from cases of bankable forest-related nature- based solutions investments, and I will describe the work I’ve been doing with NGP over the past several months to frame the investment case for realizing non-financial values within the projects NGP supports. The following article provides an overview of the preliminary thinking around the NGP investment case that will be discussed at the WFC. This article was first published on the NGP website.

The NGP Investment Case

The turning point has come and gone, and as global citizens – we’re now playing catch up to protect and restore nature. Though there are several multilateral, public and NGO organizations whose mission is to do just this – it is not enough. The big guns of private finance are needed. We need to invest in protection and restoration activities and put a price tag on the goods and services nature delivers – at scale. We’re getting a handle on the investment side, and the evolution of pricing nature’s value is ramping up – with traditional ecosystem commodities such as wood products, and the easily quantifiable service of carbon storage – but we’ve got a long way to go. We need a massive shift in economic thinking, where value is associated with less tangible ecosystem services and the sustainable development of those who are the stewards.

WWF’s New Generation Plantations platform (NGP) is well on its way to designing such a genuine bioeconomy.

Transitioning into project development

For the past twelve years, NGP has existed to support sustainable forest plantations through convening a network of forest industry practitioners and leaders, the scientific community, NGOs, communities and investors through study tours and dialogue events aiming to share knowledge and scale up sustainable forest plantations in line with the NGP principles.

NGP Principles

1. Maintain ecosystem integrity

2. Protect and enhance high conservation values

3. Are developed through effective stakeholder involvement processes

4. Contribute to economic growth and employment

Throughout this time, it has built a solid network of local practitioners on the ground and organically conceptualized various forest landscape restoration (FLR) projects that address the social, environmental, climatic, and economic aspects of forest landscape degradation challenges.

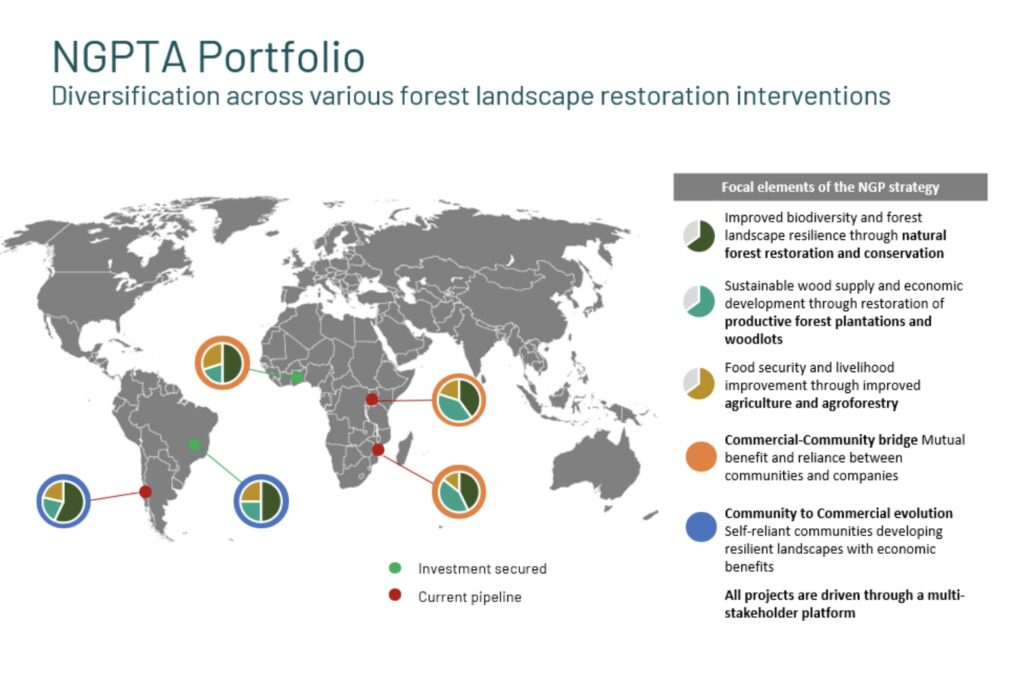

NGP has gone on to develop the organizational infrastructure, fundraise (successfully) and get boots on the ground as a project developer and implementer across South America, Sub-Saharan Africa, and Southeast Asia. As the demand for these projects increases, the organization decided to step back and intentionally develop a strategy to scale its impact across the NGP principles through its unique model. The first part of this work has been to define the investment case for NGP’s project development approach.

The remainder of this article summarizes the outcomes of this phase of the journey, which is only the start.

The Investment Gap

Over more than a decade of engaging with the business, people, and nature aspects of forest landscapes, what the NGP team has observed is that the current funding approaches engaging in forest landscape restoration are either:

- Commercially focused, where return-driven companies are resource-constrained to solve landscape challenges beyond their operational scope, or,

- Philanthropic, where social and/or environmental challenges are addressed, but the traditional donor model is short-term and tends to generate donor dependency, lacking the elements required for long-term sustainability.

For forest landscape restoration to become truly resilient and sustainable over the long-term – a different approach to financing is required. A model is needed where the strengths of business (large scale, efficient, aiming for long-term self-sustaining viability) are blended with the strengths of the donor model (able to address environmental and social needs without compromising impact objectives) and can overcome the limitations mentioned above. This is NGP’s model.

NGP’s unique approach combines the scale, efficiency, and long-term viability of traditional investment with the environmental and social impact needs of the landscape with stakeholder involvement at its core.

The NGP Investment Strategy

NGP develops projects within this gap, where there is opportunity to deliver significant impact aligned to the NGP principles – Projects that require long-term engagement on a path to self-reliance, but that may not deliver the traditional commercial returns that mainstream investors are looking for. It invests into projects across South America, Sub-Saharan Africa and Southeast Asia where it has a strong network of implementing agencies and experience. Because of the landscape approach it doesn’t support siloed projects, the projects it develops are multi-faceted and must address multiple challenges affecting forest landscape resilience in a given area. Its projects must be multi-stakeholder driven and as mentioned before, aim for self-reliance among local communities affecting and being impacted by the landscape condition.

NGP has operationalized this strategy through the set-up of two new organizations, NGPTA – which delivers technical assistance to projects, and iNovaland – which manages incoming investments and deployment to projects on the ground and contract management.

In defining the NGP investment case, it was necessary to look at the different approaches taken by NGP to fill the investment gap and deliver long-term sustainable impact. The following models were identified:

1. The Commercial-Community Bridge

In these projects, there is a mutual benefit and reliance between a forest company operating on the landscape and the communities in the vicinity of where it operates. NGP engages to provide extra resources to support community engagement in landscape and livelihood improvement and to reduce overall risk, increasing the long-term sustainability to the company.

2. Community to Commercial Evolution

In these projects, communities that are already self-reliant and engaged in developing resilient landscapes get support from NGP to organize and professionalize their activities, bringing them better access to markets, investors, and a network of relevant stakeholders.

No matter the model, the projects all deliver on three focal elements:

- Improved biodiversity and forest landscape resilience through natural forest restoration and conservation,

- Sustainable wood supply and economic development through restoration of productive forest plantations and woodlots,

- Food security and livelihood improvement through improved agriculture and agroforestry.

Though each project will lean more heavily to one element or another, depending on the context of the project, one aspect that is common across all projects is the multi-stakeholder platform. This goes beyond Free, Prior and Informed Consent – where in the case of NGP, the stakeholders drive how the project will be set up, the activities it will carry out, and the roles, responsibilities, and beneficiaries. This stretches from the small-hold farmer to the community council, adjacent forest companies, research organizations, governments, and investors.

The Investor Landscape – Investing for Impact

Investors into the NGP strategy are impact driven, where the investor mission is aligned with the NGP principles. They are aligned with the need to fill the FLR funding gap that NGP’s strategy aims achieve. It requires both a commercial and philanthropic mindset, yet the investment itself is not commercial.

Returns that NGP investors care about go beyond number of trees planted and number of jobs created – it is about long-term outcomes: improved livelihoods, income and revenues, capacity, and self-sufficiency of local people. It is about improved carbon stocks, biodiversity, and productivity in forest landscapes. These outcomes cannot be created in a short-term donor project but require time and commitment from the investor and NGP’s implementing agencies.

What’s next

Though the investment case for nature and people is clear, several questions remain.

- How can NGP leverage its ecosystem of collaborators and learning platform from its study tours to accelerate its impact across the NGP Principles?

- How can NGP attract high quality projects that align with the NGP investment case?

- How can NGP develop the “balance sheet for impact”, or MRV system to demonstrate its impact returns?

- How can NGP best communicate this impact and reach the investor profile it has described?

- How can a funding mechanism best be designed to support the long-term project engagement that is required, scale up existing projects and bring on new projects?

It is these questions that NGP is working to answer in the next phase of its strategy development, to make the NGP investment case for nature and people even stronger. If you would like to learn more about NGP, and stay informed about upcoming study tours and events, please reach out to them here.

Need support in defining the investment case for your forest restoration strategy?

Realizing the full value of forest restoration and conservation efforts is no simple feat. It involves leveraging the easily understood commercial value, such as forest products and carbon markets, and attributing value to emerging, non-tangible ecosystem services, such as biodiversity and water quality. It also includes valuing intrinsic community uplift, and value securitization through risk reduction in applying an integrated landscape management approach. If your organization is struggling to extract the value and clarify the investment case of your unique approach – please reach out to discuss