And I’m Talking to you, Project Developers…

The new era of forest investment is upon us, and with this brings different investor profiles, return expectations, markets, management expertise and so on. Just as my generation has had to learn a new digital language (emails, text messages, social media) to stay current – forest asset developers also need to freshen up their communication skills when it comes to presenting new opportunities.

You can compare this to the CV advice you were probably given early on in your career, where you were likely encouraged to at least construct your cover letter such that it directly speaks to your target employer. Sure, your CV won’t change, but you can also emphasize certain elements on it that are particularly interesting to respective prospects.

In this article, I’m going to dig into the characteristics of different investor types – and what elements may hold more value for them than others – and provide some advice that could help you to make that ever-important first impression, all without making “2 CVs”. We’ll also look at a specific case, where two different values, timber and carbon, may be in conflict and under what context this conflict dissolves.

Who are you speaking to?

The first thing you need to ask yourself as a forest asset developer is, Who is my target investor? That is, what is the profile of the organization you would like to partner with in the development of your forest asset. Reality checking this will require you to consider a few things, namely,

- What is the geography and level of maturity of the timber markets your forests are (or will be) situated in?

- What is the development stage of your business (greenfield, brownfield)?

- Is your vision or strategy for developing the asset compatible with the investor you target?

Below I describe some high-level characteristics of different profiles of forest investor to guide you in this analysis.

Experienced Forest Investors

If this is not your first kick at the can, you will know what these investors are looking for: Demonstrated track record, timber market analysis (both product type and geographical wood basket), expertise in silviculture, harvesting, processing, etc. (depending on the stage of the opportunity), sustainability and ESG management, and of course, cashflow projections and return expectations. This type of investor may or may not be educated in carbon markets but are increasingly (if not definitely) looking to see at least up-side potential of carbon revenues – perhaps not modelled in the base case financial model.

New to Forest Investment, Commercial Impact Investors

With the upsurge and mainstreaming of the climate agenda, new forest investors are emerging. This once little-known asset class is becoming widely known as a profitable and impactful climate-positive green asset, capable of delivering attractive returns and a host of co-benefits. At the same time, a chasm has surfaced differentiating among strategies that optimize for fiber production, and those that optimize for ecosystem resilience – or a more balanced return between commercial, climate, environmental and social objectives. These new commercial impact investors are more interested in the later, and in addition to the traditional forest investment case, you will need to communicate how your strategy meets these various objectives (and dare I say, more than the token “creating jobs, protecting set-asides, and storing carbon”).

Corporate or Climate-driven, Carbon-oriented Investors

Carbon investors have changed the game substantially in forest investment. Previously the forest investment universe was limited to the fiber optimization strategy, which meant that several geographies and pockets of available land were unsuitable to investment. Enter the carbon investor. Some may be interested in commercial timber returns, others may not – but all have an interest in the carbon sequestration potential of forests (whether natural or planted). If they are a serious carbon investor, they understand the carbon market inside and out. They know the price per tonne that suits different strategies, they understand the risks, and the opportunities – so if you’re pitching carbon market exposure to them, you better know what you’re talking about and don’t be shy about telling them.

Catalytic or Venture Philanthropy

Very early-stage projects, or established businesses looking to expand into an unproven business model may be interested in catalytic or venture philanthropy (see the article I recently wrote on this). This type of funding will come in different flavours, but a common feature is the objective to scale impact, and often the most effective way to do this is to attract more capital. This investor will want to see how their capital will facilitate the mobilization of additional investment AND achieve more impact.

Now I realize that not every investor profile fits in these buckets – but they are sufficiently different to help make my point. That is, how you can simply craft your communication to speak to the investor you are approaching.

The Order of Things – Pitching to your Target Investor

There is no one-size-fits-all approach to the investor engagement process. However, I would suggest something like this:

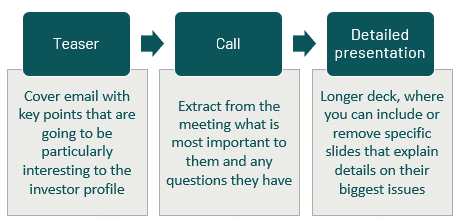

The first time you are reaching out, you need to grab their attention and not take too much of their time. Have a short teaser (around 5 slides) that summarizes the investment opportunity. Imagine they only have 3 minutes to review your project – what is going to be the most important elements for them to know. In the email text accompanying the teaser, you should highlight the key points that are going to be interesting for them. For example, if it’s an experienced forest investor – you may want to emphasize a rare opportunity in an otherwise saturated geography. For a commercial impact opportunity, the focus could be on the return expectations alongside the opportunity to protect a vulnerable intact forest. For a carbon investor, you would explain the carbon sequestration potential, and for the Catalytic Philanthropist, you would explain how much funding their investment would help to mobilize and the magnitude of impact this would achieve.

When you send the teaser and introductory email, you will invite them for a call to learn more. In this first discussion you want to answer their questions, and observe what issues are the most important to them. Assuming you have their interest, indicate that you will follow up with a longer presentation that provides more details on the opportunity.

The longer presentation should be suitable to all investor profiles you are targeting. However, there may be some “geeky details” that are interesting to some but may be too much and distracting to others. I would argue that the base deck is going to include everything that the experienced forest investor will need to know. This will still include the elements of your impact thesis, but at a much higher level. The reason is that if you go too heavy on the impacts, the experienced forest investor may see this as a drag on the return, or a distraction of management resources. On the contrary, the commercial impact investor may want to see some impact elements elaborated – for example the potential to explore partnerships with NGOs or social enterprises, more details on the vulnerable forest you intend to protect, etc. The carbon investor may want to know the specific certification standard and methodology you will apply and to understand the additionality, permanence, and leakage context as well as how this project would generate “high-quality” carbon credits. The Philanthropist will likely want to understand your expansion plan, your leads, and specifically the activities their funds will finance to reach the scale you are promising.

The Profitable Forest vs Additional Carbon Investment

A very specific challenge I observe in speaking to the right audience with new forest investment opportunities is the case of the experienced commercial forest investor versus the carbon investor. These investors want different things that may contradict each other. This comes down to the additionality of a carbon project and the commercial viability of a forest investment based on traditional wood product return drivers.

On the one-hand, developers want to promote the high return potential of their investment opportunities. At the same time, proponents want to emphasize the carbon credit generation and VCM access aspect of their projects. The challenge with this, is that if a forest investment proposition is attractive in its own right (good growing conditions, secure land, well developed markets and supporting infrastructure, etc), it could be difficult to demonstrate the additionality requirement that makes it eligible for carbon credits. This requirement basically assesses if the project would happen anyway – in the absence of carbon financing. This is one of the voluntary carbon market’s primary safeguards to ensuring that it facilitates carbon sequestration and carbon sink protection that wouldn’t have occurred in its absence.

The case for both

There are many cases where there is an opportunity for both an additional carbon investment and a profitable forest – and it proceeds in that order. In tropical geographies, the tough sell of greenfield forest investments (due to long-time horizons) is further challenged by various perceived and actual risks of underdeveloped markets and political risk among others. However, there remains a very strong underlying investment case – available and suitable land for growing trees, high population growth and a demand for wood products that far exceeds supply, not to mention all the co-benefits. Carbon investment is additional in such cases. The main reasons are that it provides important early-stage capital to get these projects off the ground, and can reduce the timeframe to cashflow positive, both of these reduce the risk for other incoming investment needed to develop a profitable forest.

Are you telling the right story?

So, my forest asset developer colleagues – are you telling the right story? Are you ticking the right boxes for your prospective investors to engage them in a dialogue regarding an investment partnership? If you need support in aligning your forest business proposition to your target profile investor, please reach out.