Register your interest here for The ForestLink’s Executive Forum. A first of its kind platform for bringing together the top leadership of forest companies in the tropics.

Though I’ve been working in forest investment in the tropics for more than ten years, I think its fair to say, I’ve doubled my knowledge in the last two since opening my own Consultancy and Advisory business. I am very happy to announce that in a few short days from publishing this article, the ForestLink will be celebrating its second spin around the sun. I wanted to take this moment to share with you reflections from my business so far in the land of forest investments in the tropics. I will share my key takeaways from the last year, and tell you how the ForestLink will be supporting the mobilization of private capital into forest investments in the tropics in 2023.

Looking back at the 2022 crystal ball

At the beginning of 2022, I made some predictions on what the year would hold in this article. In addition to the key reflections from 2021 (which are still valid today), I made some predictions for what I believe 2022 would have in store:

- More net-zero corporate and impact investor investments into forest projects,

- Best practices emerging on how to simplify forest impact MRV,

- Mainstream investment into forest investments in the tropics is still lagging (I think this will take a few more years),

- Multilateral catalytic funding is still too slow for prospective investees,

- Innovative ways to tackle the urgency issue of forest restoration, wood supply and forest protection in the tropics (new partnerships and fast-acting financing facilities) will emerge.

So how did my fortune-telling fare? In my view, rather than a lot of investment announcements into projects, we saw more commitments, investments into funds, and some industry mergers and acquisitions (where capital is largely yet to hit the ground). Standards are emerging for forest climate and biodiversity monitoring. The Science-Based Targets Initiative have released their FLAG Guidance for accounting land-based emissions and removals in the Forest, Land and Agriculture sector. The WBCSD has released their Forest Sector Nature-Positive Roadmap, and VERRA has released a new Biodiversity Methodology under its SD VISta Program. Yes, mainstream investment into forest investments in the tropics is still lagging, no surprises there. When it comes to the attractiveness of multilateral catalytic capital to investees, the jury is still out – but anecdotally, I still hear skepticism from capital seekers about the amount of redtape required to access these funds. Positively, there has been an upswing in new programs to support a range of early-stage NbS investments, and more are in the works…

Baby steps – The ForestLink’s footprint in its first two years

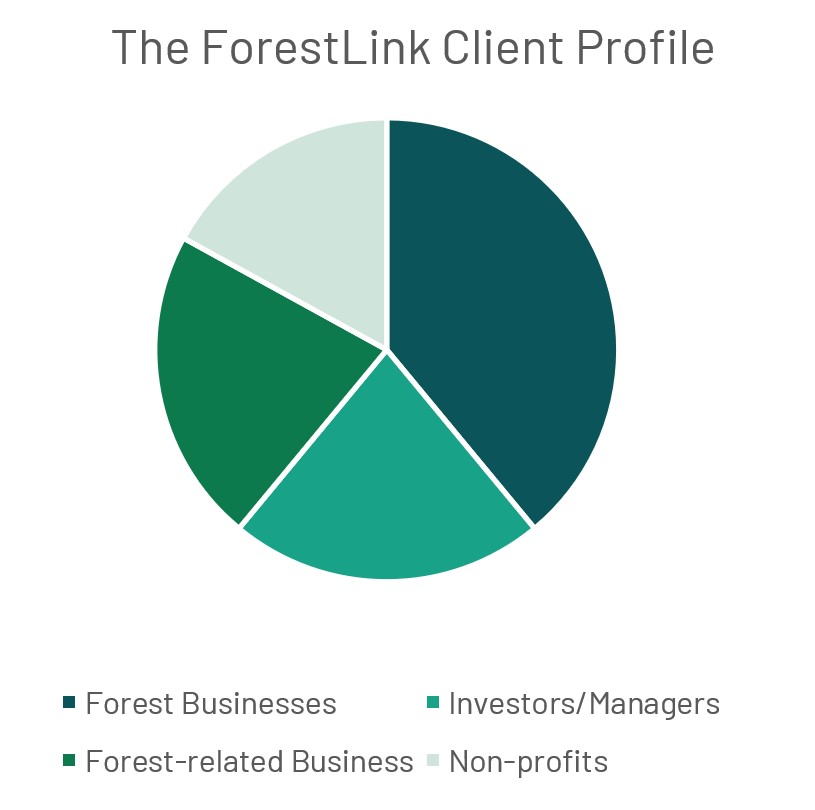

Having worked with 18 clients on 24 consultancy projects or advisory agreements, The ForestLink has worked with a mix of forest businesses, forest investors/managers, auxiliary forest-related businesses, and non-profits.

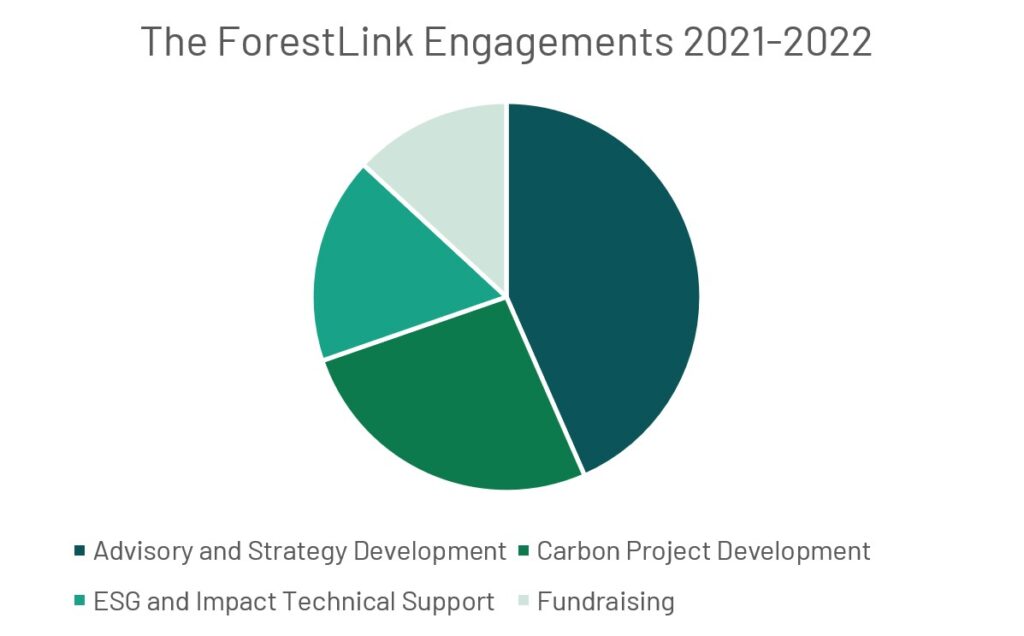

The scope of these assignments can be categorized as:

- Advisory and Strategy Development, including project pipeline development,

- Carbon Project Development,

- ESG and Impact Technical Support, and

- Fundraising.

The ForestLink has supported a variety of organizations in the development of their NbS solution or strategy, with the majority being forest businesses. Most of the work can be categorized as Advisory and Strategy development support. Interestingly, half of the work has had carbon/climate priorities as the top focus of the engagement, with the other half having carbon/climate as a strong component. In other words, all the ForestLink’s clients over the past two years have had carbon/climate objectives related to their forest investment engagements in the tropics. Though biodiversity has not been the primary focus of any assignment, 74% of projects/advisory engagements address biodiversity and are already looking to become a focal point in the year ahead.

The Year ahead for forest investments in the Tropics

This year, as with last year, I have observed some key themes from working with a variety of stakeholders in the forest investment space:

Commitments are not enough: Though the motivation for global forest restoration and conservation has been fueled by mammoth commitments over the past decade, participants are growing weary of these so-far mostly empty promises. Billions of dollars and millions of hectares are being pledged for conservation and restoration activities from both the public and private sector, yet, there are very little new developments in the space that are moving the needle forward.

We need to move beyond commitments to getting this capital into the ground.

Investors don’t know how to value NbS: Despite the science, the investment case, regulatory support, and emerging standards for best practices, investors still do not understand the investment case for NbS. This lack of knowledge quickly manifests itself as opportunities being seen as “too risky”. Investors need to prioritize getting educated, and instead of waiting for their peers to make the first move, they could take the initiative – investing into promising opportunities, where through a robust management approach, can accept and mitigate risk rather than walk away.

Investors need to get educated, and establish management systems that value environmental, climate and social impact, while reducing risk.

Urgency is a growing concern: In a conversation I had yesterday – my frustration over the urgency surfaced. “It takes seconds to plant a tree“, I said, “but it takes several years to grow a forest“. I’ve written about this in the past – forest restoration is a long game, and it is so much more than planting trees. Further, with the upswing in NbS and voluntary carbon markets – there are SEVERAL bottlenecks in the certified forest carbon project assembly line – from the availability of technical remote sensing and carbon accounting service providers, to a shortage of qualified Validation and Verification Bodies, to the thousand-long project pipeline stuck in the desk of the certification Standards themselves (and I can quote that number), it also takes years to get a project certified. Now, with Biodiversity taking the stage – as evident by a very successful COP15 in Montreal – the demand for certified Biodiversity projects will also be on the rise.

We need a mindset shift to longterm thinking amidst urgent action. This needs to be accompanied by automation in the certification process and more service providers to shorten bottle necks in project development.

Unicorn forest assets in the tropics don’t exist: I have several observations in my discussions with investors over the past two years – they want the Unicorns. They may have a bursting purse of “committed” capital, but nowhere to deploy it, because their investment criteria are impossible. They want proven and established forest assets with well-established managers. They want low-risk, high-return investments that are generating cash in the short-term and have a range of additional co-benefits. Sure, there are few of these projects, but investors – there are just not enough to go around. So, yes, Investors need to be more flexible in their investment criteria, but we clearly need to create more Unicorns!

We need to incubate and accelerate early-stage projects and support the development of managers to build opportunities investors will have the confidence to invest in.

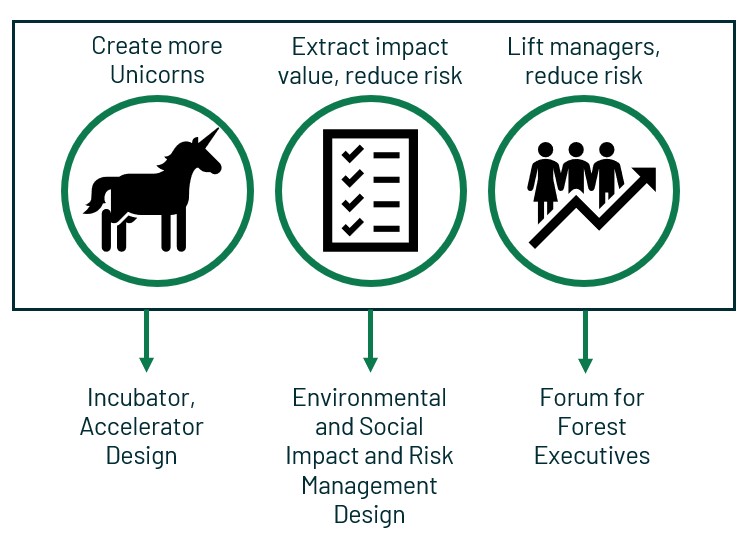

In short, to get more capital in the ground from these outstanding commitments, we need to create more unicorn assets for these investors. In my view, this requires extracting and communicating the impact value, filling the bottlenecks, reducing and managing risk and lifting the people who have the massive responsibility of executing these investments.

And this is what the ForestLink will be focusing on in 2023.

The ForestLink’s Focus for 2023

The ForestLink exists to fill the gaps preventing the flow of private capital to forestry NbS in the tropics.

Based on this, I am supporting some great clients with their initiatives to address these challenges. I have also observed a gap without any existing solutions, so I’m building an initiative of my own. To create more unicorns, extract impact value, reduce risk, and lift managers, this is what the ForestLink has in store for 2023.

The ForestLink’s focus in 2023 will be:

- Designing vehicles that can finance promising and scalable forest landscape improvement projects into risk-reduced, impact generating, profitable NbS businesses,

- Building robust, yet practical environmental and social impact and risk management frameworks for investors and managers so that they can extract the impact value from their forest investments and reduce and manage risks,

- Developing and facilitating a Forum for executives of forest companies in the tropics, to uplift their leadership skills and connect them with like-minded peers to share and learn, ultimately strengthening the management of forest investments in the tropics.

Join the Forum for Forest Executives

The waiting list is now open for the Forum for Forest Executives, which will take place over 3 days in the Spring of 2023. In the Forum, you will connect with 8-12 like-minded executives in an honest, experience-rich, and collaborative peer-to-peer learning event.

Highlights of the Forum include:

- Curated group to eliminate competition and foster open dialogue,

- Participants blended across business stage, end markets, and global tropical geographies to ensure rich and diverse discussions,

- Plenty of social time to build professional friendships among your peers,

- Dive deep on specialist topics not found in typical forest working groups or conferences,

- Executive coaching from a trained professional,

- Out-of-the box industry tour.

The Forum will be facilitated by myself, will include peer-to-peer learning led by an executive coach, and specialist training from experts on topics relevant for both your professional development and the success of your business.

Register your interest now to learn more and keep informed on when the application window opens or send this on to a forest executive you think would benefit from the Forum.

You can also reach out to me if you have any questions, or if you need support with any of my other focus areas for 2023.