Scaling Impact in Forestry alongside Financial Returns

The Transition from Traditional Timber to Scaled Impact Forestry – was the name of the panel I had the pleasure of moderating at the recent Forest and Agriculture Investment Summit in London (FAIS, 2024), where I was joined by Juan Pablo Lankenau Haas of FIA, Miriam Bellink of The Green Branch, and Warren Kemper of FMO. In fact, I would argue that the impact side of forest investment was discussed on equal terms (if not more) than the fundamentals of traditional timberland investment.

Though the fundamentals of traditional timberland investment still hold, we are entering an era of greater opportunity for forests – where we realize the multiple values that forests present, both in monetary and in non-fungible terms. Where the traditional timber optimization model looks to manage forests for the highest economic output of wood products, impact forestry looks also to elevate other forest values – such as carbon stock, biodiversity, soil and water integrity, indigenous and cultural values and so on.

Impact Forestry – from Philanthropic to Commercial interests

Before getting into the topic of scaled impact – I want to explain some key takeaways I had from other speakers at the FAIS conference.

Philanthropists called to catalyze scale in impact forestry

During discussion on The Emergence of New Investors into Forestry and Nature, Sean Penrith of Gordian Knot Strategies discussed the need for systems change in financing the forest sector. Sean spoke to catalytic capital and made the call for philanthropy to be less focused on funding forest initiatives that may plant some trees, to initiatives that can support scale and attract more capital to the space. He explained that this includes de-risking. The need for catalytic philanthropy is a viewpoint I have long shared and I have written about this here.

Natural capital allocations and impact for institutional investors

In her presentation on Optimal Natural Capital Allocations in Today’s Institutional Portfolio, Gwen Busby of Nuveen Natural Capital (NNC) presented scenarios based on an allocation model that compared a traditional natural capital portfolio, where the objective was solely to maximize risk-adjusted returns to one with combined objectives of maximizing risk-adjusted returns and optimizing it for impact (specifically achieving a net-zero climate effect on the portfolio). The scenario analysis (based on NNC’s portfolio) showed a difference in allocation to farmland and timberland (among other asset types) based on the different objectives, where timberland was present in the impact portfolio, but not in the traditional portfolio. Comparing the two, there was a negligible difference in the portfolio’s financial return between the two strategies, but the impact strategy was additionally net zero. One of the key takeaways from their research was that for all investors, incorporating impact metrics into asset allocation frameworks is key to maximizing performance and realizing natural capital benefits.

The Transition from Traditional Timber to Scaled Impact Forestry

Above, I’ve described investor profile polarities addressing impact investing in forestry – from the donor seeking only impact, to the institutional investor, looking to maximize risk-adjusted returns.

How do we have our cake and eat it too, and make sure that cake is growing?

This was the topic explored in the panel I moderated. Some of the key themes that emerged were the following:

- In an institutional investment portfolio, financial returns and impact returns can co-exist, but when it comes to impact – think quality over quantity and avoid making your investment case overly “impact heavy” so you don’t get distracted from meeting your commercial objectives.

- Experienced timberland managers are the best placed to scale and achieve profitability in impact forestry.

- The Theory of Change is an excellent strategy building tool for identifying combined impact and financial objectives, and a starting point for putting the capital, team and partnerships together for implementation and ultimately scale.

Let’s explore the theory of change further and explain how developing one early on in your forest investment strategy design can lead you on the path toward scaled impact forestry, while at the same time target risk-adjusted market returns.

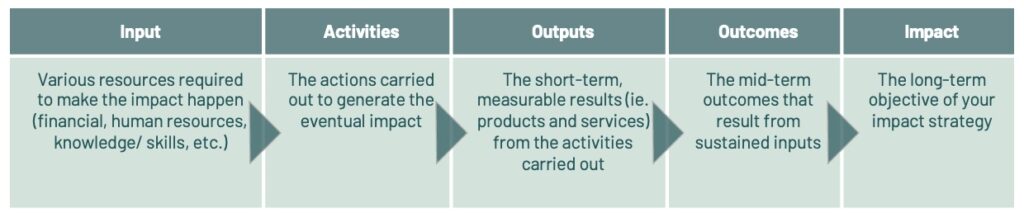

What is a Theory of Change

Traditionally a planning tool for non-profits and development agencies, the Theory of Change (ToC) plots a course from the resources put into a project, through its activities, to measurable results and finally arriving at the overarching impacts it aims to achieve – where one stage is linked to the next. In the business world, the ToC could be likened to a business model, where funding is linked to activities to deliver on financial objectives.

From a planning perspective you can see how this would be useful. As you develop your ToC, I would suggest working backwards, starting with the impact you wish to achieve. The impact will be long-time horizon (think 15-20 years), and in and of itself, may be difficult to quantify or measure. The outcomes are a series of mid-term (5-15 years) results, that are more qualitative in nature, and collectively contribute to achieving your impact. The outputs are short-term (<5 years) and quantifiable. In essence, if you want measurable metrics or indicators to assess your progress in meeting your impact targets, the outputs will serve as your milestones to show you are on track. Activities are the invested operations that give rise to the outputs, and inputs are your investment capital, and other resources required to execute the impact pathway. I have described the Theory of Change in more detail in this article.

Where I depart from the traditional, development model of the Theory of change, I like to integrate financial objectives, setting the stage for scalability and financial viability. I will describe a real example of this process below.

Join the waiting list for The ForestLink’s Theory of Change Webinar

Case Study – Theory of Change in Practice

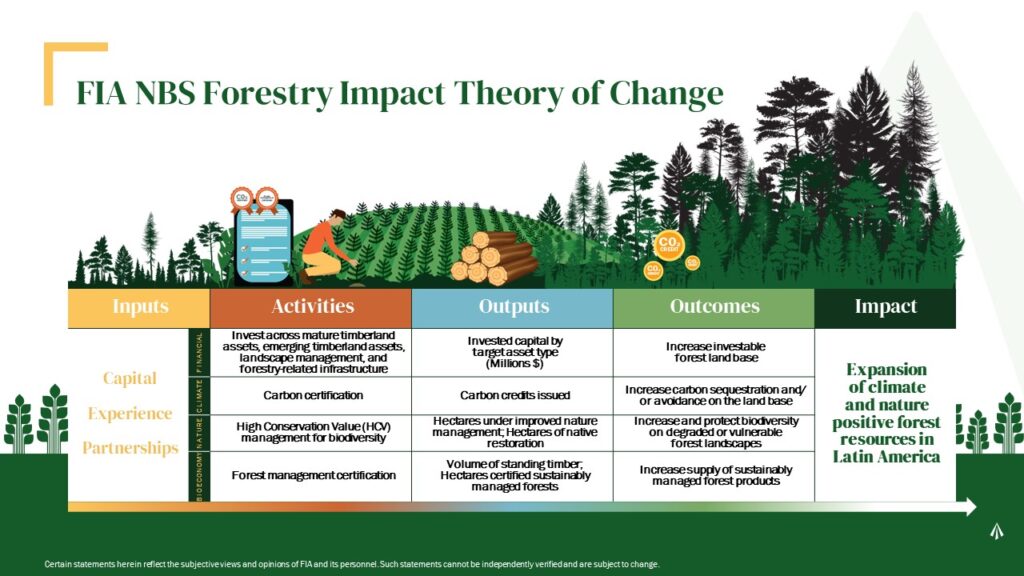

I had the pleasure of working with Forest Investment Associates (FIA) on ESG and Impact integration into their nature-based solutions investment program. Part of this engagement included an ESG and impact workshop for their management team, focused on Latin American forest investment. One of the exercises of the workshop was to align financial and impact objectives that were aligned to the investment philosophy of FIA. The highly engaging discussion resulted in the following Theory of Change that combines both the financial and impact objectives of the NBS strategy, as illustrated below.

During the panel, we walked through the scenario of how impact capital (FMO), together with an experienced manager (FIA) and an implementing party (The Green Branch) whose focus is on combined impact and commercial development, could effectively execute this Theory of Change.

Scaling Impact in your Forest Investment Strategy

If you are embarking on a new forest investment strategy, or looking to integrate impact into an existing strategy and would like to learn how you can develop a Theory of Change for your organization, I’ll be hosting a webinar on this in the autumn. Join the waiting list now, or reach out if you would like some customized support.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.