Reducing investment risks and increasing benefits – for stakeholders and your forest investment

I was recently presenting to a client on strategic stakeholder engagement and thought you might benefit from some of the overarching themes and items of discussion. To set the scene, the client is a large organization, operating under different stakeholder contexts. The organization at large has stakeholders primarily consisting of investors, customers, government agencies and civil society organizations. Its operating areas include stakeholders more closely linked to operations – such as local communities, and the labor force.

In this week’s article, I will dig into strategic stakeholder engagement, and explain how it might differ from what your current stakeholder engagement looks like, and why it might be time to revise your approach.

What is Strategic Stakeholder Engagement

According to the IFC’s Environmental and Social Performance Standards (IFC E&S),

“Stakeholder engagement is an ongoing process that may involve, in varying degrees, the following elements: stakeholder analysis and planning, disclosure and dissemination of information, consultation and participation, grievance mechanism, and ongoing reporting to Affected Communities. The nature, frequency, and level of effort of stakeholder engagement may vary considerably and will be commensurate with the project’s risks and adverse impacts, and the project’s phase of development.”

The IFC standard is primarily looking out for affected communities, however – strategic stakeholder engagement requires all of above, but also that you consider external stakeholders, and those at various levels of the business.

When I refer to strategic stakeholder engagement, what I mean is considering how you engage stakeholders in the forest investment context such that:

- If there are stakeholder groups that are key to executing the investment strategy these should be explicitly indicated.

- Stakeholders are identified and analyzed according to how and to what extent they may impact or influence the investment activities, and how and to what extent they may be impacted or influenced by the investment activities.

- Consider RISKS – both to the investment and to the stakeholder),

- Consider OPPORTUNITIES – where stakeholder engagement might benefit the investment and where it might benefit the stakeholder.

- There are stakeholder engagement policies and procedures in place that reflect a through-line from the investment objectives, maintain regulatory compliance and are aligned to relevant best practice standards.

- Stakeholder policies and procedures are sufficiently flexible to respect contextual differences and the different engagement needs of different stakeholder types.

- There is a robust feedback mechanism that includes regular monitoring, reporting, evaluation, and adaptation.

What Strategic Stakeholder Engagement IS NOT

Too often I observe forest businesses (and the investment strategies behind them) engaging stakeholders in an ad hoc way. These are some of the conditions I have seen leading to impromptu stakeholder engagement:

- A stakeholder grievance or conflict results in an immediate ‘band-aid’ from the manager – where the goal is to put out the immediate fire, without consideration for wider consequences of the action.

- Stakeholder engagement only includes prominent individuals representing the stakeholder group. It is often easier to reach the figure-heads of a stakeholder group, but here you stand at risk to not hear the opinions of the wider group, and especially the marginalized and disproportionately affected individuals or groups.

- Management decides what is important to stakeholders based on perceived risks and needs, without engaging the stakeholders or only doing so minimally.

Risks of Adhoc Stakeholder Engagement

If stakeholder engagement is not well thought through, it is not linked to investment objectives, nor does it adequately reflect risks and opportunities, the following consequences may result:

- Loss of, or failure to achieve license to operate

- Perpetual ‘fire fighting’ mode – costly and damaging to stakeholder trust

- Waste money and general resource inefficiency

- Reputational risk, loss of credibility

- Missed opportunities for benefits – both to the investment and to the stakeholders

How to make Stakeholder Engagement Strategic

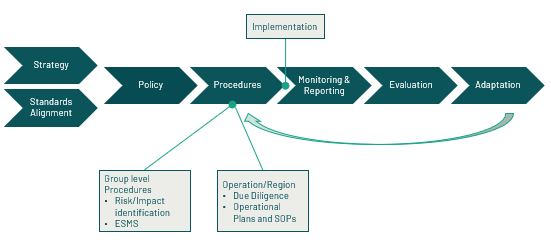

The above figure illustrates how I approach the integration of sustainability issues (such as ESG risk and environmental and social benefit creation) into the investment process. If you are a fund manager, I would consider this both at the portfolio level, and then at the asset level (where local operators design their own, aligned to fund policies). Below I describe how to view strategic stakeholder engagement in this framework.

Strategy – Will you have social objectives and targets, where you strive to improve some social elements? Or is your focus more on do no harm, and align to best practices on stakeholder engagement and human rights?

Standards Alignment – Are there any legal requirements related to stakeholder engagement? These might be financial regulatory requirements, or requirements defined in legislation of the host country of your forest assets. What about voluntary best practices, such as IFC that I originally mentioned, or the UN Guiding Principles on Business and Human Rights (OHCHR).

Policy – What commitments will you make regarding stakeholder engagement, and are these linked to your investment strategy?

Procedures – Do you have a procedure for identifying and analyzing both external and internal stakeholders? From this analysis, do you have a procedure that dictates how different stakeholders will be engaged – for example: affected indigenous peoples will require different engagement than a local NGO with an interest in your business activities.

Monitoring and Reporting – Have you identified how you will monitor the performance of your stakeholder engagement? This includes setting KPIs and a methodology. Reporting when you are considering stakeholders, refers to both investor reporting, but also reporting – or dissemination of information to the stakeholders themselves.

Evaluation – What is the process for evaluating the results of your stakeholder engagement – both within the investment and management team, but again with the stakeholders themselves.

Adaptation – Finally, if your stakeholder engagement has either resulted in missed targets, in cases where your strategy includes societal benefits, or has resulted in grievances, poor media attention, or other negative outcomes – what mechanism do you have for adjusting your stakeholder engagement policies and procedures to reach more desirable outcomes?

Improve your Stakeholder Engagement

These are some simple facts that demand stakeholder engagement is strategic:

- Investors want to stay out of media headlines, a telltale safeguard for them will be if you can demonstrate a robust stakeholder engagement framework.

- Forests are in many ways, a public good (even if privately owned) – as such, there are many stakeholders with an interest in how forests are managed, either those who are affected (like local communities), or those who may affect your business (like very vocal NGOs). Strategic stakeholder engagement ensures that your risks are minimized and that you leverage opportunities.

If you are a forest investment manager or forest business and your stakeholder engagement practices more resemble the ad hoc than the strategic approach, reach out. We can discuss how to best reduce stakeholder risks and create positive benefits, all while improving the value of your forest investment.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.