And how timber integration can and cannot help

The carbon credibility crisis is mounting. What started out as a few poignant journalistic articles, and in parallel, independent experts working towards criteria for integrity, has been transforming into price adjustments, demand in carbon project-type, change in standards and project developers scrambling to keep up. To put it mildly, the already dynamic carbon market (both voluntary and compliance) is really a rollercoaster ride, and I’m not sure if we’re on the uphill or the downhill.

In this article, I will provide a brief summary of the latest Science Based Targets Initiative (SBTi) evolution on their Corporate Net-Zero Standard, which I believe will initially impact the demand-side of the carbon market (while supply struggles to keep up) and provide some insights as to how integrating timber production as a management objective in carbon projects can and cannot help.

SBTi Net-Zero Standard Going Forward

The SBTi made waves a few months ago, in its announcement that it would be revising its Corporate Net-Zero Standard, to allow the use of environmental attribute certificates (including voluntary carbon markets) to abate Scope 3 emissions (SBTi, April 2024). After much attention and I imagine not a few meetings behind closed doors, SBTi has recently released technical publications as an early step towards reviewing the Standard (SBTi, July 2024).

As part of their homework for revising the Net Zero Standard as it relates to environmental attribute certificates and Scope 3 abatement, SBTi explores five scenarios, 3 of which are related to carbon credits (SBTi Discussion Paper, July 2024). These 3 are described below.

- Carbon credits from mitigation activities within the value chain

Where a company uses carbon credits to support value chain emission reduction within the value chain, as opposed to emissions avoidance or carbon dioxide removal. These must be traceable to the company’s value chain and be fungible with the company’s GHG emissions inventory.

- Carbon credits to support neutralization of residual emissions

Where a company uses carbon credits to neutralize residual emissions at their net-zero target year and any future emissions through credits derived from permanent removal and storage of carbon (credits from GHG removal activities).

- Carbon credits to support beyond value chain mitigation (BVCM)

The closest to traditional ‘offsetting’, but with the caveat that companies cannot purchase carbon credits instead of abating emissions at their source. Instead, this scenario explores where companies abate emissions within their value chain, while purchasing (high quality) carbon credits outside of their value chain to neutralize unabated emissions.

In relation to the last scenario (and likely the most contentious), the paper acknowledges some risks and mitigation measures. The risks relate to carbon credit projects lacking integrity, resulting in reputational damage, where there is no additionality, where expenditure on carbon credits results in lower mitigation finance available for abatement at the source of emissions, reduced incentive to abate emissions at the source, reduced incentive for upstream suppliers to decarbonize (if downstream partners opt for BVCM), and risk that claims mislead stakeholders about actual environmental performance of activities in the value chain. Mitigation measures named to avoid or minimize these risks include:

- Supply side quality criteria that include additionality, environmental, social and other sustainability aspects

- Limiting the vintage of carbon credits

- Only using carbon credits as a supplement to value chain abatement and not as a substitute

- Implement a claims system that leads to transparent and accurate claims that prevents misrepresenting the actual impact activities in the value chain.

Given the opportunities and challenges presented here as possible pathways for carbon credits to be used in the abatement of Scope 3 emissions, let’s look how timber integration can and cannot help.

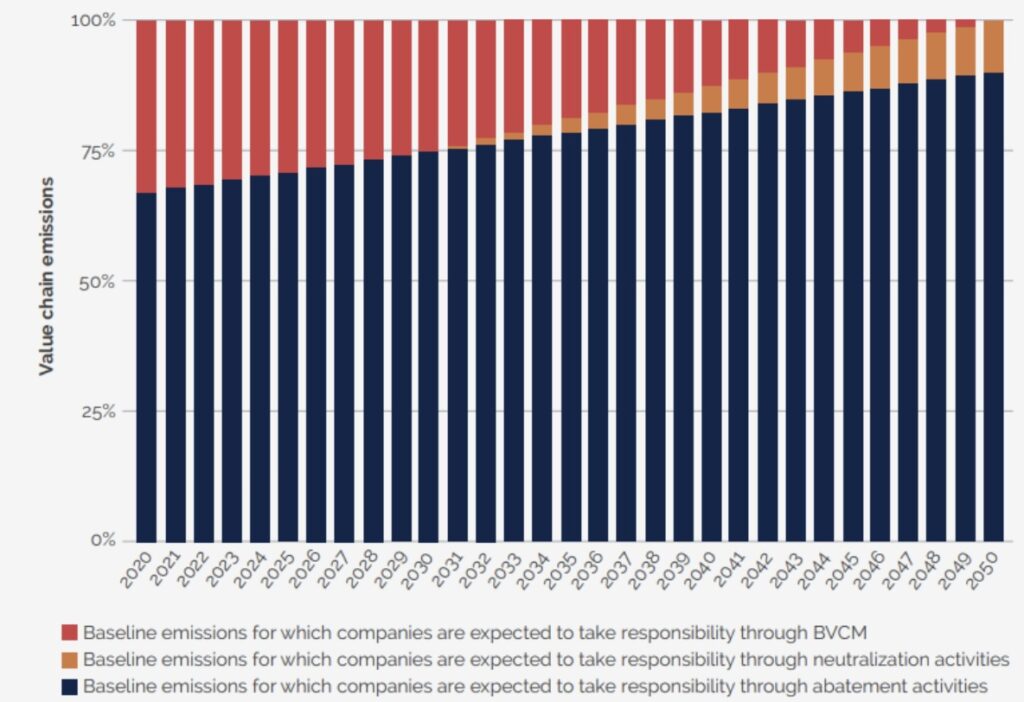

The Life Expectancy of Carbon Markets

In the carbon credit scenarios designed by SBTi, BVCM (or offset-like transactions) have a shelf-life. The illustrative example SBTi provides (below) shows that while corporates can account for more than a quarter of abatement activities through BVCM at present, by 2050, this option will be exhausted. The most significant activity now and growing through 2050 is through within value chain abatement activities, and from 2030 an increase in neutralization activities will take place through 2050.

How does timber play into this? Well, in purely economic terms – carbon markets are likely temporary (or at least declining over time), where demand for wood from sustainably managed forests is on the rise. As an investor or project developer, you need to consider this.

Where should Timber be integrated into Carbon Credit Projects?

Managing for timber objectives in forest carbon projects is logical in scenario 1 (carbon credits from activities within the value chain). This will relate to any industry that is accounting for the emissions associated with the extraction of timber products within its value chain. Some examples of direct links include:

- The construction industry

- The pulp and paper industry

- Bioenergy industry

- And many more…

Carbon credit projects associated with managed forests supplying these industries can absolutely align with this scenario. What you would need to ensure is that the forest is managed according to the high integrity carbon credit criteria, as set by the standards of the day (by the likes of major carbon credit certification standards, SBTi, and the ICVCM). I would suggest seeking out main industry players in these sectors and securing offtake agreements to help with the vintage problem. The if you build it they will come strategy is very dangerous in light of vintage concerns, where you don’t want to be left with a lot of carbon credits that can’t be sold because they are too old. In my view, the low-hanging fruit approaches for this are improved forest management and afforestation, reforestation and revegetation.

In these scenarios, SBTi regularly calls to removals – as apposed to avoided emissions. So, industries where value chains are exposed to deforestation risk, like agricultural commodities and the associated REDD+ approach for avoided emissions may have difficulty in gaining traction, more on REDD+ below.

Where Timber integration is Optional

For BVCM credit buyers – my hunch is that these buyers will place extra emphasis on the integrity piece. As timber, wood products or deforestation risk may not be part of their value chains – they won’t prioritize timber inclusion. I would expect that the BVCM credit buyer will have the following criteria for buying BVCM credits:

- Additionality is at its highest (argument against timber is that traditional wood markets will finance sustainable forest management (SFM) activities)

- Co-benefits are at their highest (project objectives include meaningful biodiversity and community improvement priorities)

- ‘Monocultures’ (you may know that I don’t like this word) will be avoided

- Activities that emphasize the reforestation of native species

Now there still is room for timber in projects that attract BVCM buyers – but I would argue that these forest carbon projects need to tick the boxes above. What this means is that timber-integrated projects will be most attractive if they:

- Are in jurisdictions where SFM is not traditionally practiced, and the additionality piece of carbon finance to spur this shift in activity is more easily demonstrated,

- Co-benefits are core benefits (in other words, not simply spin-off values of SFM, but above-and-beyond improvements to social and environmental conditions)

- Timber includes native or mixed species.

How does REDD+ fit into this? Not with Timber

REDD+, or reduced emissions from deforestation and forest degradation is moving down the totem pole of demand. In the scenarios presented by SBTi above, the only opportunity I see for REDD+ is for within value chain mitigation activities where deforestation risk is within a company’s supply chain. This is no small sector – as it includes many agricultural commodities (soy, oil palm, cattle, and even timber). It is also a sector extremely sensitive to reputational risk. See this article by Corporate Knights, titled ESG funds pouring millions into meat company linked to Brazil deforestation to emphasize my point. Though timber projects can and often make sense to include in the periphery of REDD+ projects (taking pressure off threatened intact forests, where timber extraction is a known driver of deforestation and degradation), I don’t think this is a low-hanging fruit for a forest carbon project looking to integrate timber markets.

Thoughts on Carbon Credit Pricing

(Caveat, I am not a carbon market pricing guru). That said, there are some obvious takeaways from the SBTi scenarios and credibility safeguards, that I believe will influence carbon price.

- Higher prices can be expected where vintages are recent, co-benefits are central and significant, additionality is highest, and native species are utilized

- Lower prices can be expected for older vintage projects, where co-benefits are minor, additionality is at the bare minimum, and ‘monoculture’ or exotic species are utilized.

You can hear more about carbon credit pricing in my podcast episode with Edit Kiss from Integrity Capital Advisors.

Need help building a timber-integrated forest carbon investment strategy?

The carbon space is evolving almost as fast as AI, and if you are at the beginning of your journey, it can be a daunting one – knowing where and how to jump in. If you are building an investment strategy into natural capital, and you’re wondering how to best integrate credible, monetizable climate benefits and the highly complementary and more secure return drivers from timber in sustainably managed forests – please reach out, and we can discuss a strategy that’s right for your organization.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.