Determining where in the greenfield-brownfield forest investment spectrum your strategy should invest

As an investor or investment manager embarking on a new forest investment strategy, one of the elements you will need to consider when defining your objectives is the maturity of forest assets you will invest in.

Compared to other investment strategies, where you may intend to hold an asset for a short period of time, or get engaged early on, and have the asset reach maturity in a mere couple of years – forest investment is different. The long-time horizons often have investors coming in at one stage or another, and only in specific contexts, will an investor be engaged in the very early stages through to maturity. In this article, I break down the different stages in which you might invest – and depending on your return expectations, risk and complexity appetite, and impact objectives, it will shed some light on the sweet spot of forest asset maturity for your investment strategy.

Characteristics along the spectrum of forest asset maturity

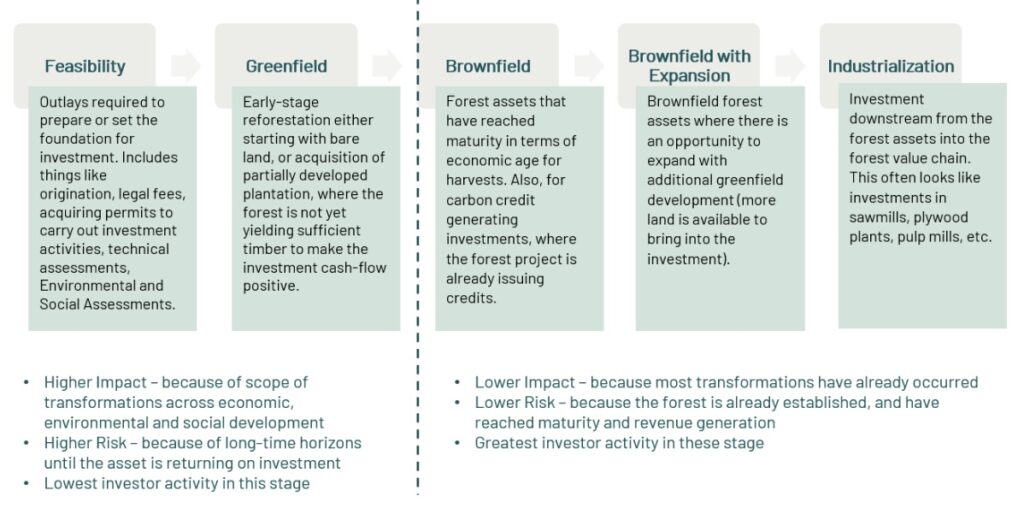

Forest investment is generally characterized as being greenfield (young forest, no positive cashflows) or brownfield (mature forest, cash generating). Though not incorrect, I think the long-time horizon that characterizes forest investment warrants a deeper delineation of asset maturity, because the fine print will shed more light on risks, returns, impact and complexity.

Below, I have broken down greenfield and brownfield into 5 stages of asset maturity and describe the characteristics that you can expect from each. Which stage resonates the most with you?

- Feasibility

As clarification, by feasibility, I do not mean due diligence (which my summary above might suggest). What I mean here – is that the project is at such an early stage, the enabling environment must be established before a tree can be put in the ground, that is – before it is “shovel ready”. This is likely to include a variety of studies, tenure and land use rights formalities and pilots. It is high risk because the outcome of this phase of investment might be that it is not feasible to develop. The ROI for this type of investment is risk reduction to commence the greenfield phase. This phase is often financed by the proponents themselves, but increasingly is being financed by forest carbon financiers, with the agreement that the financier will benefit from credit revenues or access to the credits. The impact is high in these strategies because you are essentially starting from scratch, so everything is indisputably additional. Complexity should be relatively low, if there is a good project manager in place that understands all facets of establishing a forest investment.

- Greenfield

In my groupings of asset maturity, I consider an asset to be greenfield if it is either shovel-ready or is in the early stages of reforestation. It is a period where OPEX is dedicated to forest management activities, where there are no sales from either harvesting or carbon credit sales (as the case may be). It is a higher risk than the feasibility stage, because there is more capital at stake, execution risk remains high and there is still some time until the project is generating revenues. The return profile will vary depending on the context, but the investment case is based on the premise that your land costs and cost of developing the asset will be surpassed by the value you’ve created in the forest asset, which is reflected in the price paid by the next phase investor (where the price should reflect risk reduction, biological asset value and in some cases, land appreciation). As in feasibility, impact is high because of the additionality, and complexity is relatively low – as the focus is on executing solid forest management.

- Brownfield

Brownfield assets are revenue generating, whether by timber harvest or carbon credit sales. Risks have greatly been reduced and many extinguished. Assuming there is not much growth planned in the business (in the way of expansion or processing), the expected ROI will be less than a greenfield investment because of the higher upfront investment, but with regular cashflows due to revenue generation from timber sales or carbon credit issuances. Impact in a brownfield investment is generally low, because environmental or social gains have already largely been achieved. Depending on your impact objectives, there may still be a possibility to achieve additional impact – such as improving gender diversity across the management team or adjusting a forest management regime to produce more climate benefits. Complexity is greater than the other asset maturities mentioned because you are operating across a full rotation, potentially engaging in processing and executing sales, while continuing to replant after harvest.

- Brownfield with Expansion

In a brownfield with expansion investment, you are essentially combining at least brownfield and greenfield assets in one, and potentially also feasibility. It can be a very suitable model where investors like the risk-reduction and regular cashflows of brownfield but are looking for growth and an eventual greater ROI than a pure brownfield asset. Though the asset will be risk reduced across several factors – you would need to consider other risks, such as capacity for management to expand, and a potential drag on your solid brownfield investment if something goes wrong in the expansion. The impact potential is raised because you are expanding into undeveloped area, however complexity increases – as you are managing the full cycle of your brownfield, while also establishing a new site from scratch.

- Industrialization

Whether a brownfield investment or even a late greenfield investment – you may need to consider investing in industrialization. This is often necessary in immature markets where the value chain is not fully developed and there aren’t industrial players within an economically feasible proximity to your forest asset, and/or where raw log sales are either not feasible or not economical. The risks are very different – relating to management capacity and human resources, understanding the CAPEX and OPEX needs, permitting issues, health and safety issues, available technology and servicing, etc. Justification of the investment often rests in assured sales of the product you will manufacture via long-term offtake agreements. Return potential will depend on the other factors I mentioned, and it can be a quite lucrative undertaking if industrialization will secure sales channels for higher price, value-added products. Impact potential can be great – in creating more skilled labor opportunities and providing economic development. On the environmental side – depending on what is the nature of your industrial investment – you may improve the emissions or environmental footprint compared to the alternative, or you might worsen it, be sure to consider this.

Investor activity

Most forest investors, even long-term investors prefer brownfield forest assets because of the risk reduction, and regular cashflows. Even though impact generation is likely on the low end – if the forests are managed sustainably – brownfield forest assets still provide investors with access to ‘green’ investments. One of the challenges with this preference, means that there is a limited investable universe, with increasing natural capital investor interest. This may translate to over-inflated asset values.

If you are an investor with strong impact requirements, you will likely be more interested in greenfield opportunities. There are other benefits associated with more immature assets – obviously the investment needed is much lower than brownfield and you are also in more of a ‘blue ocean’, where competition for greenfield assets are less. If you’re financing feasibility – competition is zero because you are essentially originating the deal from scratch.

Finally, no one is saying you must choose one level of asset maturity only – a strategy that invests across the value chain can support institutions with a diverse risk-return-impact profile.

Need support defining the right forest asset maturity mix for your investment strategy?

If you are in the early stages of defining your forest investment strategy and could use some support in defining where along the forest asset maturity spectrum you should invest to meet your objectives, reach out. We can discuss your priorities, concerns and identify your unique sweet spot to benefit across the forestry value chain.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.