But Curiosity in Foresrty’s Climate, Nature, Circular Bioeconomy and Social Impact themes, is not matching allocations

Register now for the Theory of Change Webinar

Last week I had the pleasure of attending the Global Impact Investing Network (GIIN) Impact Forum in Amsterdam. It has been six or seven years since my last GIIN Forum and, my how things have changed. At my first GIIN, there was nothing on the agenda related to forestry – but this year, the topic dominated the discussions. This week, I want to share some of my key takeaways on impact forestry coming out of the GIIN.

The Forest Investment Interest vs Allocation Conundrum

Forests dominated the GIIN agenda – across sessions such as Planetary Boundaries, “Can Cutting Down Trees be Good for the Climate?” (BTG Pactual – TIG), “The Investment Opportunity in Nature (AXA IM Alts), Investing in Nature – Delivering Climate and Biodiversity Impact at Scale (Palladium and FMO), Unlocking “Just Transitions” for Nature and People Through Private Investment (Mirova), and Investing in Sustainable Forestry for Climate, Biodiversity and Social Impacts, where I had the honor of moderating an all-female panel, alongside Anne Valto of Finnfund, MaryKate Bullen of Forest Investment Associates, and Veronica Ayzaguer of Agroempresa Forestal.

Despite this, the recently published State of the Impact Investment Market 2024, Published by the GIIN, shows that among surveyed investors – only 1% of AUM, and 15% of investors are investing into forestry related themes. Why don’t these ends meet?

Well – I have several observations from the GIIN which I believe answer the question on why investors aren’t putting their money where their mouth is. Let’s explore the interest, the barriers and the solutions.

Impact and Financial Investment Opportunities in Forests

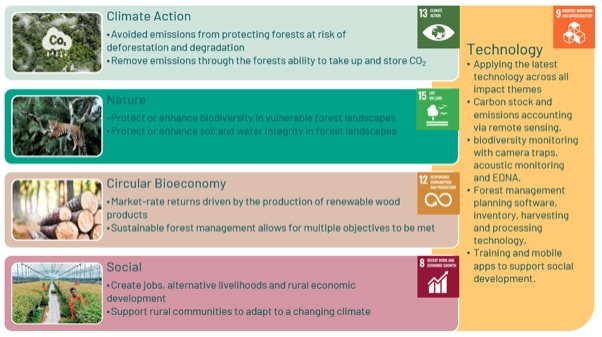

On the impact side, Forest investments are gaining traction in their ability to deliver on several impact themes. I have summarized the main ones in the figure below.

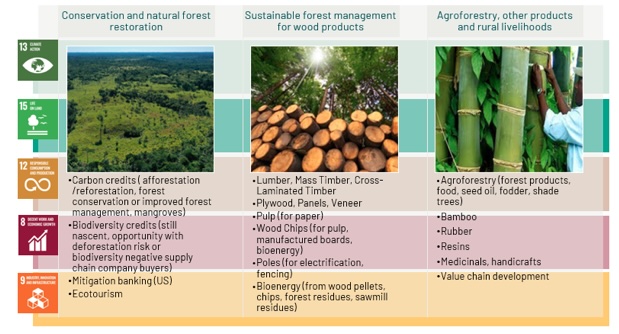

And on the financial side – forest land, whether in natural forests, managed forests, plantation forests, agroforests, and everywhere in between are opening up all kinds of assets. You can see some of the market themes in the figure below.

The opportunities are countless. And throughout the forestry-related sessions I mentioned above, experts guided us through the opportunities and explained in simple terms the investment fundamentals and ‘how to’ engage in the space. The sessions were full, and there wasn’t enough time to address the questions posed by all the raised arms – and I believe this to be case-in-point, why we’re still seeing the low numbers of engagement in forest investment.

Barriers to investing in forestry

Now, I could go down several rabbit holes here – but I want to stick to my concrete observations from the GIIN when it comes to identifying the barriers to investing in forestry. First and foremost is lack of education or understanding about the asset class, and the many different ways to invest in forestry. From intensive plantation forestry in the US South, through to conservation of the biodiversity-rich Congo basin and everything in between. Different strategies, call on different capital needs, investment vehicles, risk-return-impact expectations and so on. Many of the questions coming from the audience indicated that though there is interest, a vast majority of would-be investors are still in the very early days of wrapping their heads around the asset class.

Related to the education piece, was what I would call – misaligned ideals or expectations. Investors want a lot out of the asset class, and often their multiple objectives are not compatible – or at least would be very difficult to achieve. For example, de-risked high-impact strategies. In forest investment, as I would guess in other asset classes – risk and impact have a linear relationship – where the highest impact potential often comes from the riskiest strategies. Take for example the wish to have high-integrity, high biodiversity outcomes alongside stable market-rate returns with low risk – depending on the nuances, this is a challenging thesis to deliver on.

I also find that one of the benefits touted about forestry and nature-based solutions, where forestry presents the cheapest mitigation pathway to slow and reverse climate change – but this is also a challenge for raising capital. Though the cost-effectiveness is true, and has eons of evidence backing nature’s ability to remove CO2 from the atmosphere and store it – to some investors these are not the criteria they are after. Big ticket institutional investors are often looking to deploy huge sums of capital and are wooed by shiny un-proven technological climate solutions. Forestry requires a more patient, slow-release of capital over a longer time horizon, and this is just not attractive to some investors.

Emerging Solutions

Despite some of the barriers I observed, I also saw some great evidence of solutions to some of these problems. From BTG’s strategy, where one of their Fund’s has bought hundreds of thousands of hectares of degraded and intact Brazilian Cerrado forest, where they are developing the land for a mix of production forest, conservation and nature restoration objectives – and they are doing so at scale. This will make larger ticket sizes possible for those bigger impact outcomes, and bigger returns. They have also been fairly quick to deploy, meaning that they are ticking the urgency box as well.

Additionally, I had a few conversations with developers of impact bonds – who are in the process of designing investment vehicles to fill the gap in forest investment funding. Impact bonds were originally designed for social outcomes in such fields as healthcare and education but are now turning to the forest. In such a structure, philanthropic capital pays for forest improvement outcomes, and investors can subsequently access high-impact risk reduced opportunities. Funding outside of mainstream private equity structures can support the catalyzing of this larger pool. Whether impact bonds, blended finance, project financing for carbon credits or others.

Get off the fence, and into the Forest

In the panel I moderated, we explored the impact themes associated with forest investment and had an interactive session, where participants were able to work together – consider their motivations for investing in forestry, discuss any reservations – and work together to design forest investment strategies. I closed the session with the call to action for investors to get off the fence and into the forest. Unfortunately, time was limited – BUT – if you want to go deeper on developing your impact thesis, aligned to financial objectives. I am holding a Theory of Change webinar on October 30th to do just this. Watch this video to see if its relevant for you – or Register now.

Register for the Theory of Change Webinar

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.