The Importance of Profiling Investors for your ESG and Impact Integrated Forest Investment Strategy

Asset Managers wear at least two hats.

On the one hand, you’re selling. You raise capital for the investment products you deliver to investors. On the other hand, you’re buying. You are the investor looking to deploy the capital you’ve raised (and probably some of your own) into assets aligned to your investment strategies.

In my previous two articles on building a pipeline and deal origination – I spoke to the buy-side. Today, we’re talking about the sell-side and raising capital – in particular the extra step I would encourage you to take if you’re embarking on a new forest investment strategy that integrates ESG and impact. I’m talking about profiling your investors. In this week’s article, I’m going to give you three reasons why you want to profile your investors (and when this is unnecessary).

When Investor Profiling is Unnecessary

If your investment products or strategies to date have been more or less similar, and you’re offering more of these – then investor profiling is not that critical because you already know what your investors want – you understand their risk-return profile and what characteristics of forest investment they’re interested in. Your approach to fundraising, need not change – if you’ve successfully raised this type of capital for this type of product, its working – stick with it.

When Investor Profiling is Necessary

But… If something has changed in your offering that may attract a different type of investor, you want to make sure you are speaking to their wants and needs. And when we’re talking about a forest investment strategy that has a focus on ESG and Impact – then you’re going to be looking for investors who also care about this. Sure, some of your existing investors may also be aligned to the new strategy, but you already know how to communicate the merits of this strategy to them. But if ESG and Impact is a focal element of your offering (ie. more than a few sentences on sustainability and how you seek forest management certification, provide jobs and contribute to a green economy) then you need to get real in understanding your investor, so you can emphasize the ESG and Impact focus in the right way. Below are three specific reasons why you want to profile your investor.

3 Reasons Why you want to Profile your Investors

1. They need to see themselves in you and your product

If you’re either new to natural capital and forest investment, or your next strategy is going to be integrating ESG and impact in a way you haven’t done before – investor profiling is important. Think about first impressions – a phone call, a teaser, a pitch deck. You have a few precious minutes to make that first impression and within those moments, investors need to see themselves in you and your product. By understanding their wants and needs, you can better communicate how your strategy will meet them.

More and more, investors are drawn the forestry or timberland asset class for more than its fundamental characteristics of inflation hedging, diversification, and long-term, stable, risk-adjusted returns. They may be looking for sustainability features. How you embody and communicate this is important. Let’s look at what might happen if this precious first impression is a mismatch.

If an investor resembles a conventional institutional investor, where their sustainability requirements are light or non-existent and you’re spending a significant amount of time explaining and describing the sustainability elements of your strategy – you’ve lost them.

But on the other hand, if an investor seeks market rate returns, but in parallel is also seeking tangible climate and nature objectives – and you gloss over these later elements with a sentence or two – they might not believe that impact is as important to you and your strategy as it is to them.

If you understand the impact profile of the investor you are speaking to – and speak to who they are and what they want, first impressions and subsequent conversations will run smoothly and your entire capital raise will be more efficient.

2. Avoid unmet expectations

Fundraising for a new forest investment strategy is a journey, especially when speaking to new investors. It takes time for them to get to know you and build trust. If you’re in discussions with an investor who knows clearly what they want – the conversation on aligning expectations will be easier. If you’re early in the strategy design phase, investor input could even reshape your strategy to ensure it meets their needs. However, let’s say you’ve already had a first close, your terms and conditions of the strategy are nailed down and you don’t have the flexibility to adjust your strategy. In such a case or if you’re seeking a co-investor for an already invested asset – you need to be crystal clear on the profile of the investor to avoid unmet expectations. Let’s say its paramount to your existing investors that the asset follows IFC Environmental and Social Performance Standards, and that these are externally audited against – this may bring extra costs and investment restrictions. If this isn’t important to other prospects, you may be wasting your time, or run the risk of losing trust with your investor if this is not communicated to them. Likewise, maybe you need a robust remote sensing or Lidar service provider to monitor the carbon stock and enhance forest fire surveillance in your investments. If an investor doesn’t see the relevance of this and the extra costs, they won’t be in alignment.

3. Facilitate additional capital raise

Unless you’re working exclusively with separate managed accounts, its likely that you’ll require capital from more than one investor – it could be into a Fund, it could be a club deal, or you could seek co-investment into an asset you’ve already invested in. It’s important to profile your investors and understand their selling points and limitations for meeting additional fundraising requirements. For instance, maybe you have a corporate investor from the fossil fuels industry as an anchor in your Fund strategy. You may find that some of your prospective LPs have policies against partnering with such companies. Or you may have multi-lateral funding secured which is off-putting to mainstream private capital because of concerns over public information sharing and confidentiality or excessive red tape. On the positive side, you may secure investment from a development finance institution (DFI) that is considered a leader in forest investment, which will likely attract several other DFIs to the strategy, because often this investor category shares the same profile and have the same wants and needs.

It’s important to understand the profiles of the investor best suited to your strategy and be aware of any potential limitations that a certain investor or investor profile might bring.

How to Profile Your Investor

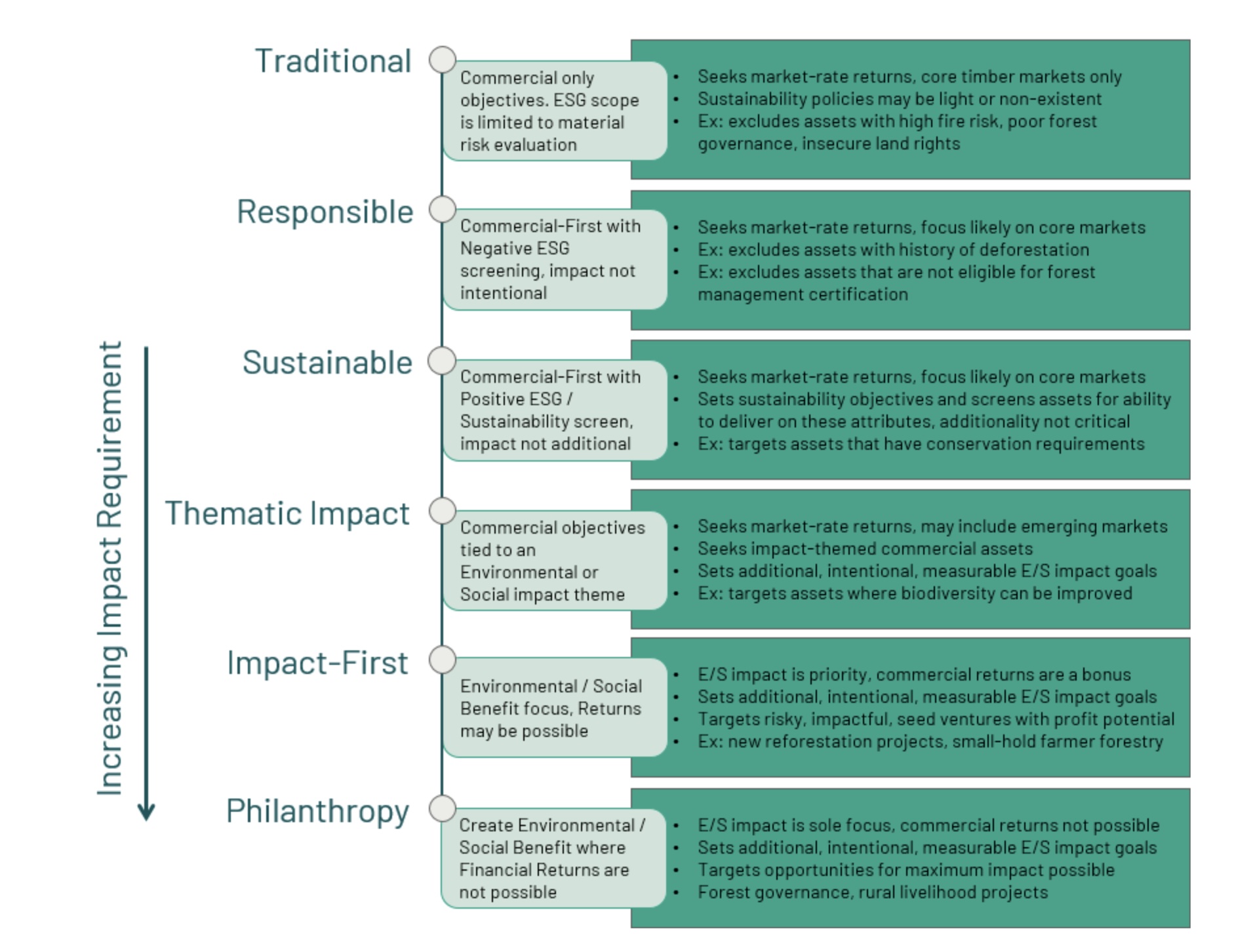

Below I’ve created a simple schematic for some basic investor profiles along the impact investment spectrum. If you’re in the midst of a new ESG and Impact integrated forest investment strategy, consider these profiles as you build your Investor pipeline. This will help ensure focus and an efficient strategy in your fundraising process, so that you don’t waste time and money speaking to investors who are not the right profile for your strategy.

Are you Seeking the Right Capital?

If you are an Asset Manager and you’re either in the thick of fundraising for your ESG and impact integrated forest investment strategy or you’re about to start, and you could use some support getting inside the heads of sustainability-focused investors, let’s have a conversation. I’d be happy to support you in making your approach to fundraising more targeted so that you can get your capital to work faster.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.