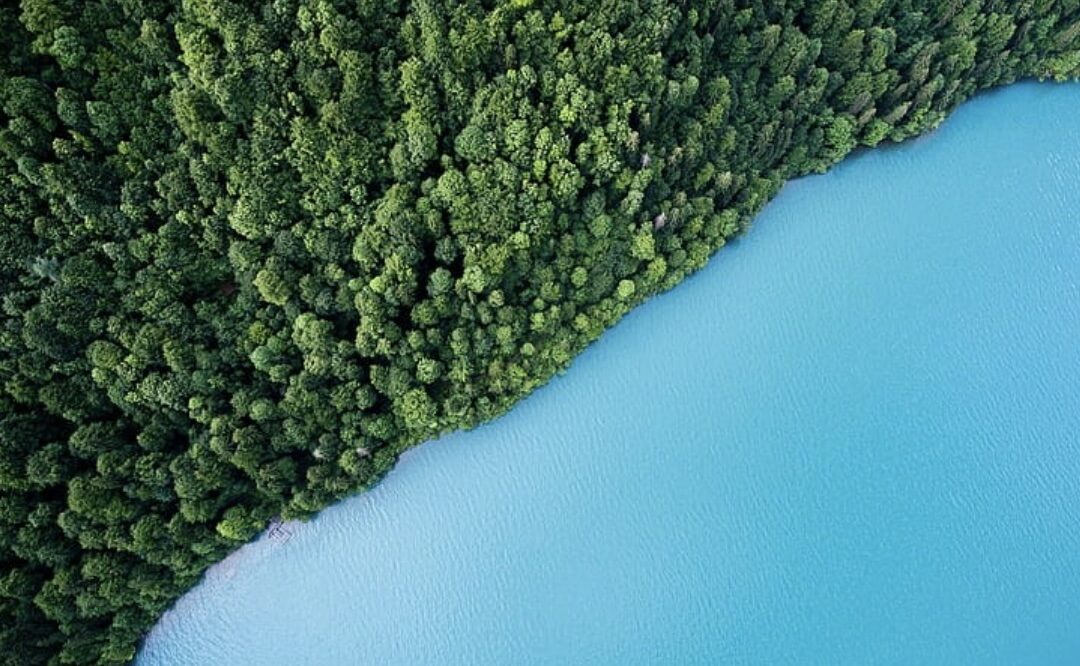

Don’t leapfrog critical steps in your biodiversity objective setting Have you ever seen a child take their first steps? As a mother, I’ve watched this milestone unfold twice—and while I was there to cheer them on and remove hazards, the progress was all theirs. First,...