Last year, during a drought (I live in Northern Italy, where we weren’t making headlines for forest fires, but for the lakes being at an all-time low), we were having some earthworks on our property to channel ditched uphill farm runoff into a pipe. When they were installing the pipe – I commented to my husband that I thought the pipe was too narrow. We went ahead with it anyway. Flash forward to this year, where the other night we experienced an unseasonable rain/hail/thunderstorm (sidebar – Northern Italy is now making headlines for its flash flooding). Our directed ditch water started barreling over at the entry point, wiping out the yard where we plan to build our garden office. Luckily, we haven’t made the investment yet! I had an “I told you so” moment with my husband, commenting that we’re living in climate change. It’s not coming, it’s here. This coming into focus further with the World Meteorological Organization’s recent climate update forecasting a period of global temperature rise above 1.5 degrees within the next five years.

This got me thinking – though we all know the double benefits of climate change mitigation and adaptation in forest investment – are we actively managing for adaptation? Not just from a risk perspective, but also from looking at opportunities? In the context of my yard, let’s assume we had built the garden office – it would have suffered significant damage if not total destruction. On the risk side – what if instead we had used a different size pipe, or had a run-off planned? On the opportunity side – what if we had installed water tanks to catch the overflow to water our garden during drought?

When it comes to considering climate change adaptation in forest investment, we must also consider the risks and opportunities.

As you may be aware from previous articles, my approach to ESG in forest investment – is managing environmental, social and governance risk, benefits and investment value creation. In this latest article, I’m going to put the spotlight on climate change adaptation in the context of forest investments, from the lens of my ESG approach.

Defining Climate Change Adaptation in the Context of Investment

In their recent article, How to mobilize private-sector finance for climate adaptation, the World Economic Forum defines Adaptation Finance as financial resources aimed at helping communities, companies, countries, and regions adapt to the impacts of climate change. The article goes on to explain a significant gap in adaptation funding, naming the following as obstacles to attracting this capital from the private sector:

- Perception that there is no money to be made – perception that returns are public benefits, not competitive risk-adjusted returns,

- Information asymmetries and knowledge gaps – definitive data on climate impacts, future risks and likely adaptation outcomes of the adaptation project is lacking, making investment decisions difficult,

- Investment horizon and size of adaptation projects – long time horizons and small ticket sizes make large up-front investment difficult to rationalize amidst the unknowns.

The article emphasizes that adaptation finance needs are greatest in developing countries, but that the already challenged investment case will likely see private adaptation capital being channeled into developed economies. This leaves developing countries, and the most vulnerable and ill-equipped to adapt to climate change reliant on largely absent public funding. This is precisely the context for vulnerable forest landscapes in the tropics.

Adaptation Finance in Forest Investment in the Tropics

Let’s consider the adaptation possibilities within the context of forest investment in the tropics – where vulnerability is high. Below, is a summary of some of the common climate change risks associated with forest investment in the tropics. Rather than stopping there, as everyone is too quick to point out the hurdles – let’s focus on solutions; climate change adaptation interventions that reduce risk, create impact and add investment value.

Climate Change Risks Relevant to Consider in Forest Investment

- Acute climate events (wildfire and storms) increase in frequency and severity,

- Climate norms change, resulting in chronic climate effects – regions experiencing more or less rain that normal, higher or lower temperatures at different seasons than normal,

- Climate refugees emerging especially for rural, subsistence farmers in vulnerable developing countries where livelihoods and water access may be impacted,

- Landslides, erosion, siltation

Investment into Climate Change Adaptation

| Intervention | ESG Risk reduction, Impact Generation, Value Creation |

| Fire and Storm Management Develop wider-community engagement systems for surveillance, prevention, first response, and health and safety protection Invest into prevention, detection and suppression technologies, equipment, and training | Risk is reduced through increasing local awareness (locals often initiate wildfires) Risk is reduced through being ready with skills and resources for early detection and suppression of fires/storm damage before it becomes catastrophic Social impact generation through empowerment of locals (this article shows a great example of a community-wildfire management system in Ghana) Investment value through building local talent, and an asset demonstrating best-in-class management |

| Community Resilience Programs Support community-climate resiliency programs such as the development of agroforestry systems – where integrating trees in farms improves soil and water regulation, provides shade, and additional crops Increasing tree cover in climatic zones that buffer desert regions with drought resistant species that have added socioeconomic benefits (think timber trees, fruit/nut trees, bioenergy, fodder, etc.) | Risk is reduced through giving communities alternatives to slash and burn agriculture and charcoal burning (livelihoods that threaten forest assets in the tropics) Social impact is created through livelihood diversification and resilience and empowerment of local communities Environmental impact is created through soil and water regulation, prevention of deforestation and desertification Investment value is generated through participating in offtake agreements with smallholders for their agriculture, timber, or carbon generation. |

| Climate-Resilient Forest Mosaics Manage for forest mosaics – different age class structures, species compositions and management objectives to ensure a more resilient forest Tree planting on vulnerable hillsides with species known to develop extensive and deep root systems Avoiding tree harvesting on sites vulnerable to erosion and siltation Post-harvest remediation to deconstruct temporary roads established during harvesting that create risk of channeling water into sensitive soils | Risk is reduced through structural and species diversity mitigating wildfire spread and mass-pest and disease outbreaks Environmental impact generation through mosaics increasing biodiversity, structural diversity, soil stability and water-cycle regulation Investment value through providing access to diverse wood markets and steady wood flow (mixed age classes and species) |

| Research and Development Establish species trials to test adaptability of new species or varieties Have a soil expert analyze your site, and suggest how soils are likely to perform given climate change projections for the area | Risk is reduced through having more tried and tested species to choose from, if previously well-performing species fail Risk is reduced through increased knowledge on the biological, climatic and soil/water conditions of your site, enabling better forest management and environmental impact is created through acting on it Investment value is generated through optimizing the growing potential of your site in the face of climate change Investment value is generated through contributing to data, where it is scarce – making the investment more attractive to future investors |

Going one step further to demonstrate investment value would be to model the progression (specifically the financial and carbon impacts) of the asset with and without these (or other) adaptation interventions.

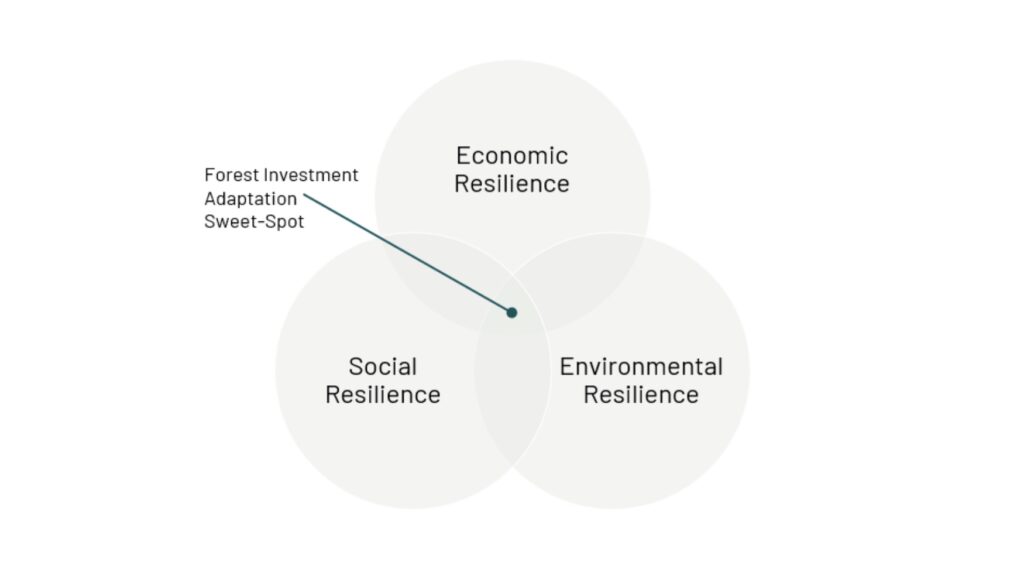

The Forest Investment Adaptation Finance Sweet-Spot

In summary, the sweet-spot for where to invest in adaptation, is those activities that will promote economic resilience – that is strengthening timber and carbon markets, and creating alternatives or substitutes for high-emission products, such as concrete, steel and plastic. Social resilience – supporting livelihoods that assume the climate will change, and diversion away from activities that put vulnerable communities more at risk (such as forest degradation for fuelwood collection or slash and burn agriculture practices) with alternatives. Environmental resilience – planting and managing species that can withstand climate variability, including extremes.

Forest Investment Action on Climate Adaptation

Above I have listed some common-sense tactics that forest managers can apply, and often do – for the most pressing of risks – such as fire prevention, and suppression. However, I would encourage, as part of the design of an environmental and social management system (ESMS), that as forest investors design their investment strategies, and as forest managers design their management plans – that climate change adaptation is given deep consideration as part of the ESG risk and opportunities assessment.

Where WEF acknowledges the put-offs of adaptation finance – it assumes investors are only looking at ESG from the risk perspective. I would encourage investors to also consider ESG opportunities. Where is there opportunity to not only contribute to public and environmental benefits but prosper as well.

If you are looking for support to develop your adaptation strategy that combines both an ESG risk and opportunity approach, please reach out, I’d be happy to help you create resilience in both your business and for the communities and environment in which you operate.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.