The Forests best suited for your Investment depend on the type of Investor you are

If you are new to forest investment and are getting up to speed on forestry as a natural capital investment theme – you may have been presented with some opportunities or searched out case studies to better understand the characteristics of a forest asset. Some might resonate with you immediately, while others may not. Some might leave you completely confused.

If you are an experienced forest investor or manager of forest assets, you probably don’t even think about what kind of investor you are – you just know when you see a strategy or asset that resonates (or design it yourself).

In this week’s article we unpack the financial-impact investor spectrum, so that you might identify yourself, and understand the types of assets that could be suitable to your investment objectives.

The Spectrum of Financial-Impact Investment Priorities

In my view, the first place to start when designing a forest investment strategy is to identify your investment priorities. In a previous article, I discussed the motivations for investing in forests as a first step in approaching forest investment. Equally important is understanding the type of investor you are, and respecting that the purpose of your capital (financial returns, impact creation, or a hybrid) needs to match your motivation (commercial drivers, climate, nature or social impacts).

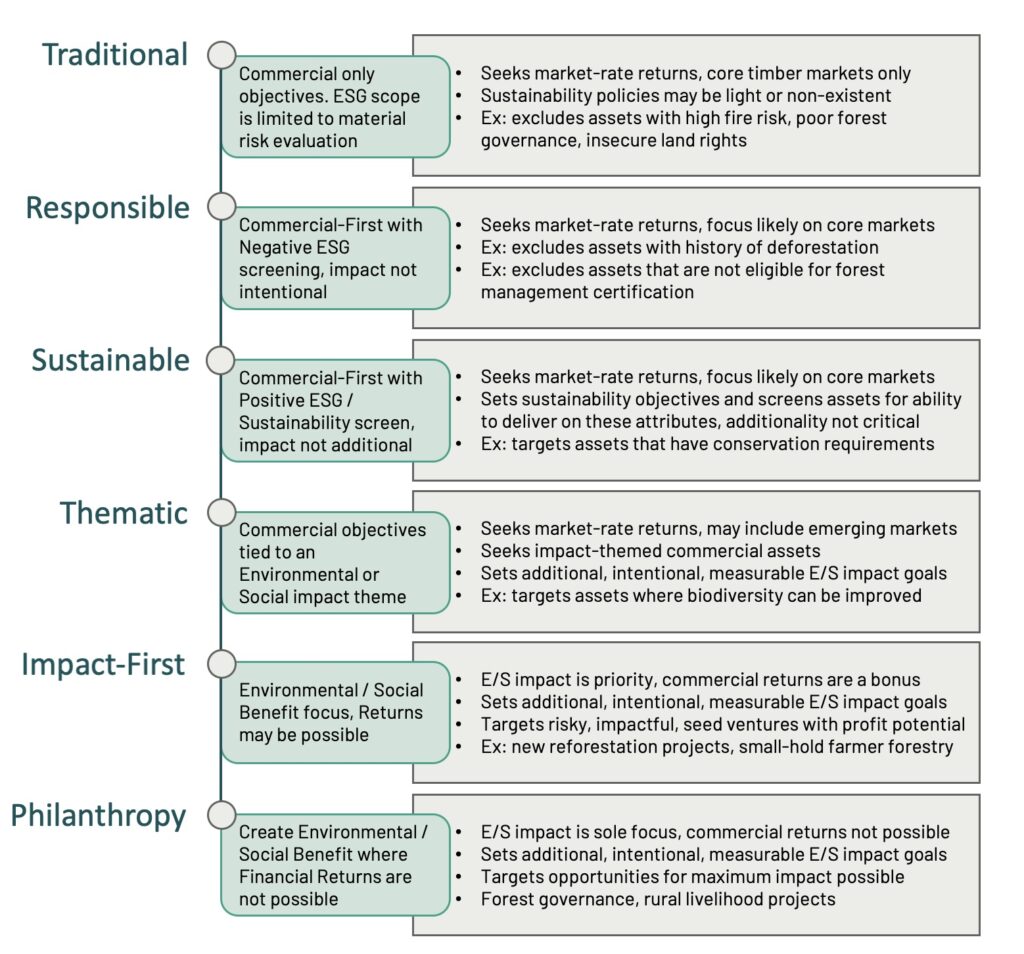

Are you mandated solely to secure a long-term financial return on investment, or are you investing with the sole purpose of solving an environmental or social challenge? Or are you somewhere in between? In the following figure, adapted from The Bridges Spectrum of Capital, I summarize different types of capital providers with an example of how they might approach forest assets.

Figure: The Financial-Impact Investor Spectrum for Forest Investments

Let’s dig into these a bit further…

Traditional forest investment

A mature forest plantation in the US South or a semi-natural forest in the US Northeast or Pacific northwest, with regular and predictable harvest schedules on private land, close to processing facilities where there is a low fire risk. Other core markets may include Australia and New Zealand.

Responsible forest investment

The same assets as described for traditional forest investment, but where the investor screens deals to ensure the asset is either forest management certified (or eligible). It may have more sophisticated negative ESG screening criteria for climate, deforestation, erosion, land tenure, and forest governance risks (the later two might exclude entire jurisdictions based on land rights and the effectiveness of forest governance).

Sustainable forest investment

Sustainable forest investors build on the previous two by setting sustainability objectives with their investment strategies. In addition to looking at ESG risk (like the responsible investor), they will also include a positive screen for assets that ‘tick the box’ in meeting the criteria for their sustainability objectives. It might be that the strategy targets 15% of their invested land base to be protected natural forests. They don’t need to improve climate, environmental or social conditions of the assets they invest into, but these assets need to have sustainability credentials aligning to the investor’s objectives.

Thematic forest impact investments

This is the first forest investor type that is impact-focused. With a strong distinguishing feature from other impact investors that they also have strong commercial objectives. This investor chooses the forest asset class because it supports an impact theme they have – such as biodiversity enhancement, or emissions removals via nature-based solutions (I expand on these themes in the motivations article). Assets selected may not already fit into the sustainable or responsible categories, but there must be an opportunity to improve the condition of the impact theme through the investment. In addition to financial objectives, the investor will also set impact targets, manage for these (alongside commercial operations) and monitor their performance.

Impact-first forest investment

This investor places more emphasis on the impact potential of their forest investment activities than the commercial returns. Thus, they will be able to invest into riskier assets where there are significant impact gains to be realized. Here, you will see more emphasis on investing into emerging markets and early-stage forest businesses – where there is significant opportunity for market development, climate change mitigation and adaptation, reforestation and conservation, and sustainable development.

Philanthropic forest investment

This investor donates funds to finance activities in the forest that will never be financially viable. Appropriately allocated forest philanthropy will look for both high impact, and long-lasting impact. In this article, I discuss catalytic philanthropy, where donor funds can be used to scale impact and longevity through investing into activities that either set the foundation to mobilize more sustainable investment, or have mechanisms to ensure impacts are sustained into the future. Catalytic philanthropy into forests could be moving the agenda forward around gender equality issues in land rights in forest dwelling communities, or commissioning biodiversity studies or high-tech biodiversity monitoring systems to support conservation. Either of these examples (and others!) could include partnering with a commercially-focused forest operation, which will help you reach scale and longevity – rather than the typical donor model that works with a specific scope over a short-term.

What about Carbon Finance?

Forest carbon finance is where the spectrum I describe above gets fuzzy. That is because the climate benefits generated from a forest investment may be seen as an environmental service, yet they can also be monetized or priced. On the philanthropy end of the Impact-Financial investor spectrum, the objective for carbon finance is purely for climate gains. This might look like supporting small-hold farmers with a transition to climate-smart agriculture and agroforestry, where donations finance inputs and the transition period, where farmers might experience a drag in revenue, as the land adjusts to a shift from monoculture, and heavy pesticide and fertilizer use and where tree crops take time to deliver their own benefits to an agroforestry model. On the traditional side, it might be a large corporate purchasing low-cost, low-risk carbon credits needed to balance out their carbon footprint. Somewhere in between you would find a corporation looking to develop a forest carbon project, where they are looking to achieve both the financial benefits (for example selling the credits for a return, or retiring the credits themselves) and other environmental and social co-benefits, such as nature restoration and livelihood development.

I know my Investor type – Now What?

Knowing what type of investor you are is a good starting point, but what do you do with this information? The examples in the schematic are helpful, but they are not concrete enough to build a forest investment strategy. The ForestLink is preparing a guide to support investors like you, to ideate your forest investment concept. This guide will have more concrete examples, so that you can better envisage the types of projects that would align with your investment objectives. Register for The ForestLink newsletter to get your hands on the guide when it comes out, or set up a consultation to discuss your ideas.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.