BloombergNEF recently announced the publishing of The Biodiversity Finance Factbook. The publication provides finance, policy and sustainability professionals with important data to gauge current and required finance flows to biodiversity and further identifies where funding should be prioritized and how to make it happen.

Though I don’t think any of us would disagree with their suggestions on what is needed, implementation is another story.

In this article, I will explain why the traditional forestry asset class is hesitant to bite on biodiversity beyond the status quo. I’ll then go on to describe how biodiversity “investments” can be more palpable and attractive to the asset class.

The Biodiversity Funding Gap and What to Do about it

The Biodiversity Funding Gap

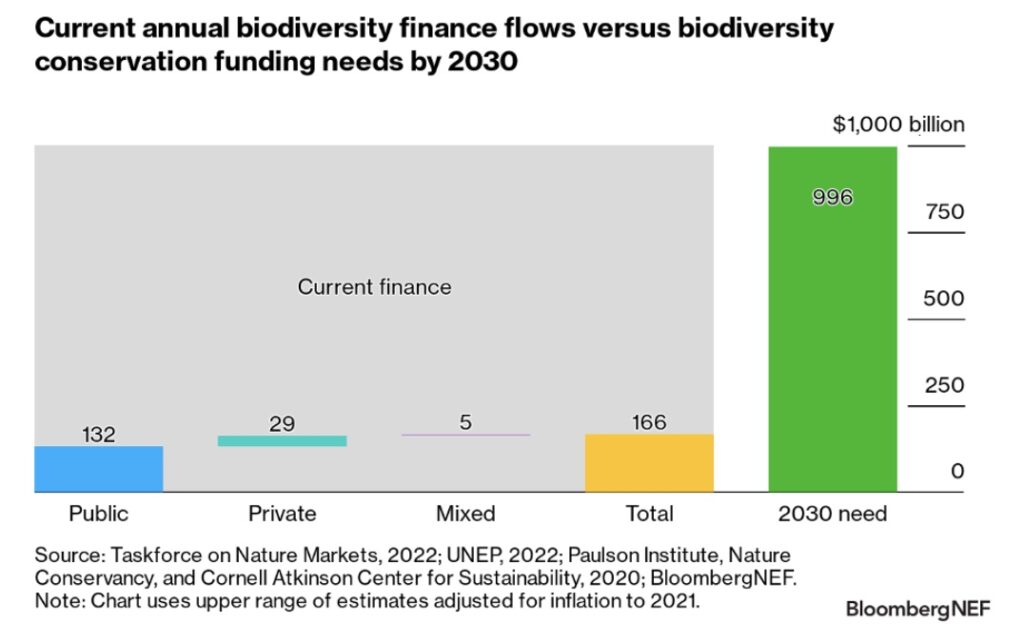

Like so many of its colleagues, attempting to draw attention to the need to restore and protect biodiversity, Bloomberg quantifies the challenge through showing current financial flows to conservation. They indicate an $834B gap from today’s spend to the 2030 need.

Total current funding is a mere 17% of what is needed by 2030, with only 3% of this coming from private finance.

The How of Escalating Biodiversity Finance

In their article, $1 Trillion to Protect Biodiversity is Cheaper Than the Cost of Inaction, Bloomberg identifies the main challenges to mobilizing capital to biodiversity conservation efforts, and complements with the following solutions:

- Standardize data, metrics, and frameworks

- Integrate biodiversity into business as usual (planning, operations, reporting)

- Policy support

- Availability of bankable biodiversity projects

- Improve the environmental integrity of offsets

- Achieve industry and local community buy-in

Let’s consider these suggestions within the context of forest investment.

Forest Investment Aversion to Biodiversity Investment

I’m going to be calling out the elephant in the room here – and that is the perception by (most) forest investment managers that biodiversity restoration and conservation challenges the investment case of the asset class.

For the forestry asset class, biodiversity is seen as a cost. Incorporation of mixed species, protection of decaying wildlife trees, retaining dead and down wood, maintaining gangly hardwoods all take up space where highly productive, proven commercial species thrive. The industry is further challenged by long time horizons, logistical constraints, skilled labor shortages and so on. These constraints add cost, the concern of the industry – is that biodiversity will not add value to an investment it will take away from it, by adding yet more cost. The following are some reasonable concerns they face:

Perceived Biodiversity Costs in Forest Investment

Reduced productive area Biodiversity protection or restoration areas will take away from the commercial forest land-base,

Net-loss in revenues

Conservation and restoration activities will add cost, without contributing to revenues (biodiversity markets are nascent, and apart from carbon, ecosystem services are so far unmonetized),

Added logistical challenges

Maintaining biodiversity protection or restoration areas within a commercial forest will challenge logistics, ie. harvesting and transporting logs out of the forest without damaging conservation areas will take more care (aka time) again, adding costs,

Complex silviculture

Planting mixed species for commercial production will create operationally sub-optimal silviculture regimes (from lack of quality genetic material to complex stand management for each species, and different rotation ages).

No processing capacity or market

Planting mixed species for commercial production will be challenged if the local industry (processing) is not suited to handle other species, there also might not be a local end market for those species.

Lack of knowledge

Lack of knowledge in how to adequately manage biodiversity in the first place (including target setting, defining appropriate interventions, deciding on metrics to monitor performance).

Low-hanging Biodiversity Fruit for Forest Investments

So, how can we take the advice of Bloomberg, and convince the naysayers (aka mainstream forest investors and managers) that investing into biodiversity is worth it? How do we convince those who can tangibly quantify that the costs of biodiversity action (as indicated above) are higher than inaction on their balance sheets?

We need to pick the low hanging fruit.

Nobody said that the most costly and restrictive biodiversity protection and restoration efforts should be the focus.

The easiest way to increase the private sector’s contribution to biodiversity conservation is to have it come at little cost and have it deliver tangible bottom-line improvement.

Given Bloomberg’s suggested actions, the following table identifies some low-hanging fruit to make biodiversity restoration and conservation more palatable for the nay-saying forest investment managers.

| Driver of Biodiversity Finance | Low-hanging Fruit for Forest Investments |

| Data, metrics, frameworks | – Forest management software must include biodiversity elements for easier modelling, planning, implementation and monitoring – Managers need to integrate biodiversity into their planning from the outset, selecting KPIs to measure progress that are easy to manage for and measure (and that are ideally represented in software applications). |

| Integration of biodiversity into BAU | – As above, ensure biodiversity targets are set, incorporated into the forest management plan, and easy to measure KPIs that are regularly monitored – Target easy to implement interventions – see the next section for some ideas – Report on biodiversity performance as well as the financial impact of biodiversity interventions (this will support future planning and allow for identifying the best biodiversity value interventions) |

| Policy Support | – Liaise with government regarding policy support and financial incentives for biodiversity positive forest management interventions |

| Bankable biodiversity projects | – Consider joint ventures, where the high biodiversity value areas of your forest management unit are co-managed by another business or community group looking to manage for and monetize biodiversity benefits (or do this yourself) |

| Environmental Integrity | – Set biodiversity targets, measure baseline, manage, monitor and report – and do so publicly and transparently, – Consider “do no significant harm” elements, or risks where your general forest management operations may negatively impact biodiversity and disclose this (SFDR is a good reference) |

| Achieve industry and local buy-in | – Promote the biodiversity interventions you are implementing across the industry and to local stakeholders. This will set you apart from companies managing under conventional forest management practices. |

Easy to implement interventions

Below are some ideas of concrete interventions that you could execute that will not be detrimental to returns on investment:

- Focus conservation areas in inoperable forestry areas (such as steep slopes, wetlands and riparian areas, buffer zones with neighbours)

- Focus conservation areas in “unproductive” forestry areas (unproductive for commercial forestry does not mean unproductive for biodiversity). Again, think wetlands and rocky areas.

- Intervene by keeping out. Allow nature to restore itself, merely by staying out of an area.

- Prevent invasion of exotic commercial species in protected areas, by cutting down single exotic trees that propagate in protected areas.

- Support biodiversity research through permitting a university or research institute to study the impacts of your management on biodiversity (at no cost to you, and you benefit from the data)

- Support the development of high-quality native species propagation, by allocating a small section of your nursery to growing native trees seedlings and allocate a small portion of your forest land base to R&D for growing these trees

- Sponsor university research on native or mixed species market development (in areas where the industry and market favours single species)

- Consider mixed, native species buffers in fire breaks as “green” fire breaks.

To understand the tangible bottom line improvement of such activities, requires solid financial modelling. Run sensitivities on your financial model with the assumptions of the intervention and the impact on returns. Think in terms of long-term opportunities – for example: increased market-share of nature-positive forestry as consumers/shareholders inevitably become more demanding on biodiversity criteria, fire and pest risk reduction, development of new biodiversity markets and markets for native species.

Low-Cost Biodiversity Improvement in your Forest Investment

If you are a forest investment manager or forest business resonating with the biodiversity costs I mentioned above, and you would like to integrate low-cost biodiversity enhancement solutions into your forest investment – please reach out. I’d be happy to support you in defining practical, credible and impactful biodiversity improvement and conservation that is not a drag on your bottom line.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.