6 Tips to Efficient and Successful Forest Investment

Forest investors and investment managers could learn a thing or two from Goldilocks and the Three Bears. The story goes that Goldilocks stumbles upon a house in the woods, which holds several temptations to a girl weary from wandering the forest. Whenever faced with an option – be it porridge, a chair or bed – she chooses the one that is “just right” for her own needs.

Investors or investment managers preparing to deploy capital into forest assets – need also to prepare in a way that is “just right”. That is, a sufficiently deep strategy, investment thesis and investment framework to make informed and responsible investment decisions, yet light enough to allow for flexibility and efficiency.

In this article, I reflect on past client engagements on forest investment readiness and identify 6 ways you can invest more efficiently and ultimately, successfully.

Forest Investment Strategy, Thesis and Framework

Before getting into what ‘just right’ looks like, it must be prefaced that ‘just right’ will be different for the type of investor you are and the amount of capital you are looking to deploy. What is needed for a $500M Fund will be different than a single $5M allocation.

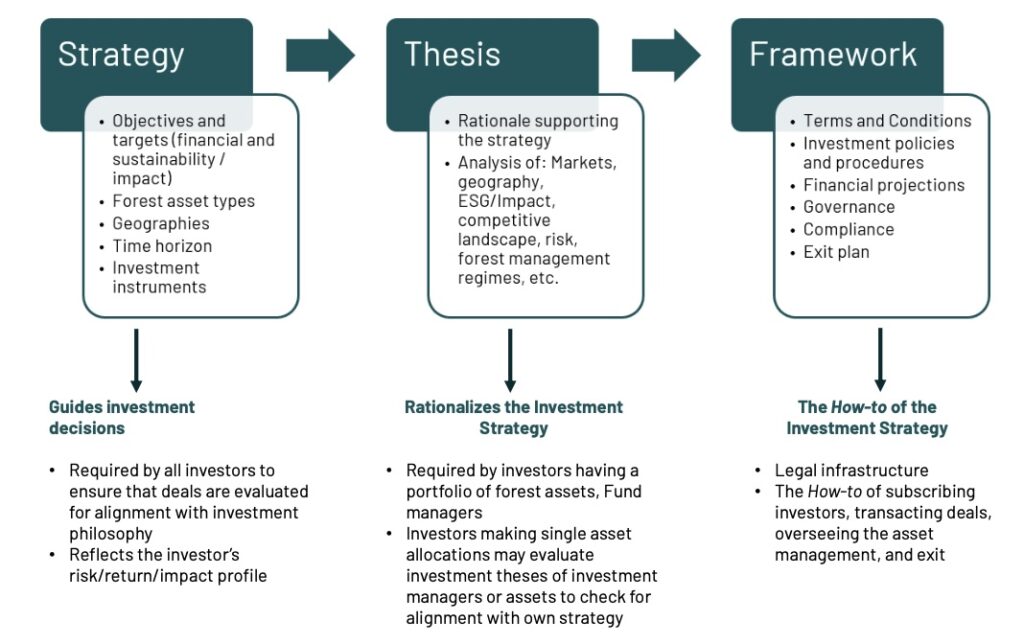

I would argue that if you are fundraising and/or building a portfolio you require all of an investment strategy, investment thesis and investment framework. A small, single allocation would be fine with only an investment strategy and can lean on industry white papers and the legal infrastructure of the deals they are considering in most cases without elaborating their own investment thesis and framework. In breaking down these terms, a strategy provides you with a north star to guide your high-level investment objectives, the thesis provides all the facts describing the investment case, and the investment framework includes all the documentation that facilitates i.) an investor’s due diligence on your investment product, ii.) your due diligence on the deals you evaluate, iii.) the legal transaction, and iv.) eventual investment management. See the figure below for a summary.

This article focuses on the more complex investment readiness, such as developing a new forest investment fund.

When Forest Investment Readiness is Too Light

A forest investment strategy that is too light is one that appears rash and emotionally driven. It might include conflicting objectives, such as high return expectations on a forest conservation strategy, or high-return expectations on short-term greenfield strategy.

An investment thesis that is not backed by sufficient data will deter investors from considering your investment product and will make it difficult for you to wisely originate suitable deals. It can lead to an investment framework that will set up the oversight of your investments for failure.

For investment managers raising capital for a new strategy, a light investment framework might get you to market faster, but as investors start evaluating your investment product – you will need to build-as-you-go to meet investor demands, which can be a slow iterative process – resulting in the hurry-up and wait phenomenon. A hallmark sign of an investment product that is too light, is one in which there is a poor pipeline of suitable deals.

When Forest Investment Readiness is Too Deep

I have seen investment products where the investment strategy, investment thesis and supporting investment framework are so detailed and stringent that the asset manager cannot find suitable deals.

Such over-readiness can be counter-productive and lead to excessive management costs. Much time can be spent accommodating each prospective investor’s investment requirements – when they may not even invest in the product.

Even if you are successful in raising funds, by having such inflexible investment requirements, you may get to the end of your investment period unable to fully invest the capital you raised.

When ‘Just Right’ is not enough

You may have a balanced investment strategy, thesis and investment framework but lack management alignment in your organization to get your new investment product successfully over the finish line.

As timberland investing is evolving to a more integrated forest investment approach, I have seen several times the case where the team developing a new strategy with sustainability objectives is met with some resistance from members of the organization having a mindset rooted in rigid timber maximization fundamentals. This dichotomy of views can create a lack of investor confidence in new products launched by such organizations. Investors see the management risk or lack of management alignment and doubt in the ability for the manager to manage both financial and sustainability objectives.

Find your Forest Investment Readiness Sweet-spot with these Tips

From helping clients move through the challenges listed above, I can offer these tips to getting your investment strategy, thesis and framework off the ground, so that you can more quickly get your capital or the capital you manage, to work on the ground.

- Start a listening tour with your prospective investors – At the outset of a new strategy, speak to your prospective investors to understand what they are looking for. Some institutional investors openly share their investment criteria and DD requirements. Through early discussions, you can start preparing your investment thesis and framework from the beginning with this in mind (but beware going to deep at the early stage).

- Do some research – If you are new to forest investment, take the time to get up to speed on the asset class. If you’re experienced with timberland investment and are in some way embarking on unchartered waters within climate and nature themes, get up to speed on the new angle of your strategy. You simply cannot make responsible investment decisions without knowledge.

- Get in the field – Depending on your budget, this may need to be a virtual fact-finding tour – but you need to see some deals that would fit your strategy. If you can’t take your strategy from the conceptual to the practical, you will join the masses of investor commitments that are unable to place funds where they can’t find a pipeline.

- Engage in strategic partnerships – Depending on your strategy, a strategic partnership can help you either build your pipeline of investment opportunities (funding to get projects investment ready), implement certain aspects of your strategy (like NGOs that can implement the conservation aspects of your wider production forest strategy), or other businesses operating in the forest value chain that also have nature positive and climate positive objectives but aren’t directly involved in forest management. This approach can be especially helpful when integrating financial and sustainability objectives.

- Invest in origination – In addition to fact-finding missions, participating in or hosting study tours, or funding feasibility studies can help you build a pipeline of investable projects suitable to your strategy.

- Invest in management cohesion – If you’ll be overseeing your forest investments within a team – take the time to ensure that everyone is on the same page. This is especially important if your new strategy is quite different than other strategies. Without buy-in across your organization, you run the risk of having difficulty in attracting capital, having difficulty in executing the strategy, and ultimately making successful investments.

Get help with your Goldilocks Problem

Are you stuck in understanding what is ‘just right’ for your forest investment strategy, thesis, or framework? I help investors new to the forest asset class design ESG and Impact aligned forest investment strategies and experienced timberland investment managers evolve to integrate more sustainability objectives. Reach out and we can discuss your needs.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.