and equipping investment managers to increase financial flows to forests

The ForestLink’s mission is to mobilize more private capital to profitable and impactful forest investments. As such, I am thrilled to be participating on a panel focusing on this topic at the upcoming International Forest Business Conference in Poland. For those of you who will not be in attendance, I wanted to share my position on this grandiose topic. For those of you going to the conference, I’ll be seeing you next week!

Current Capital Flows to Forests via Climate and Biodiversity Conservation Pathways

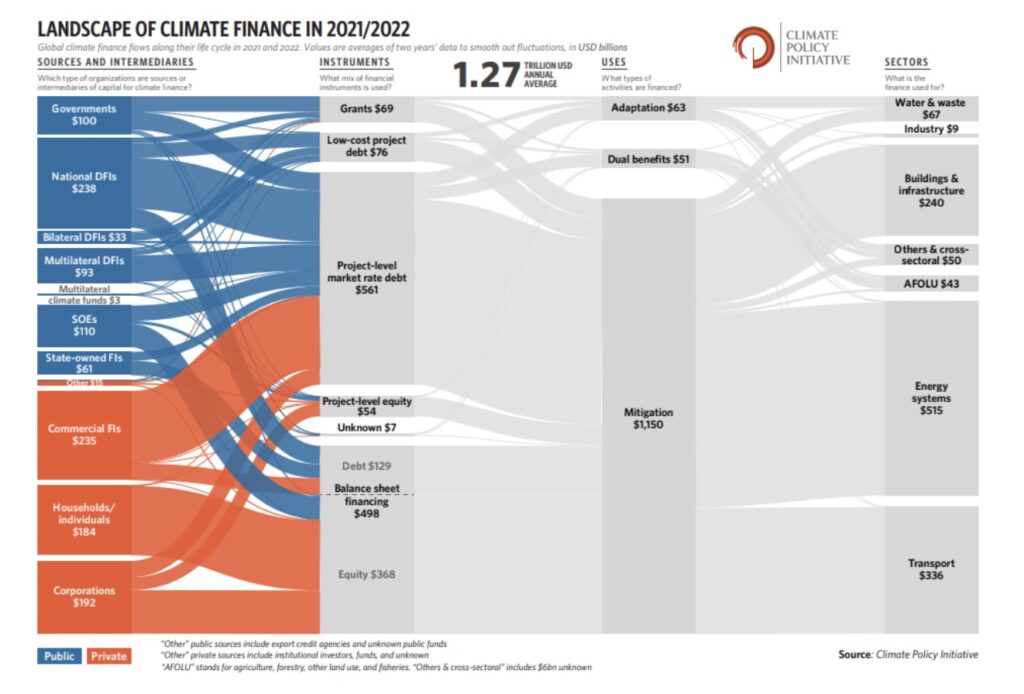

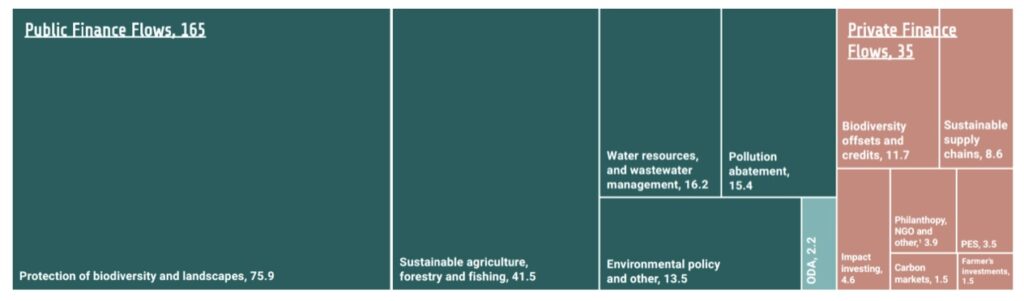

A picture is worth 1000 words, or in this case trillions of dollars. Maybe it would be more appropriate to say what is lacking. The figures below depict the current flows of capital to climate, and nature. In summary, forest-linked climate and nature spending are falling well short of what is needed, and private actors are called upon to pick up the pace.

When we look at climate, average annual climate finance flows reached almost $1.3 Trillion in 2021/2022, nearly doubling compared to 2019/2020 levels, according to the Climate Policy Initiative’s Global Landscape of Climate Finance 2023, with nearly 50% of funding coming from private actors. Looking closer into these details in the figure below, you will see that only $43 Billion was channelled to the AFOLU (mitigation and adaptation), or Agriculture, Forestry and Land Use sector – or 3.3% of climate finance. AFOLU is identified by the IPCC as having the largest climate change mitigation potential of any sector, but where only $7 Billion of the 43 is mitigation finance, it needs to grow >180 times.

When it comes to biodiversity conservation, the below figure from UNEP’s 2023 State of Finance for Nature, indicates that in 2022, $75.9 Billion flowed from the public sector. This number is more than twice the private capital flowing to nature from different sources. The shocking number, however is that the report finds $7 Trillion being channeled annually into activities with a direct negative impact on nature.

What needs to be true to move more private capital to forest investment

With such a lopsided public vs private investment, what needs to change to attract more private actors into this equation? Well, you don’t need to be an economist to figure it out, but in short, the following needs to be true:

- For investors – There needs to be a clear investment case, with strong market fundamentals.

- For businesses – There needs to be a clear business case for climate and biodiversity-targeted spending, where profits can be strengthened, costs can be reduced, or tangible business risks can be reduced.

- Regulations require investors and businesses to channel capital into forests, climate, and biodiversity conservation.

At present, sustainable production forestry attracts private capital for obvious reasons, where climate and biodiversity remain voluntary. The investment case and business case for emphasizing climate objectives is building, but biodiversity is still lagging.

What are the sources of private capital available for forests?

Now that we’ve established the need for private capital to meet forestry, climate and biodiversity conservation objectives, let’s look at the sources of that capital in its simplest terms: 1. Private actors who haven’t invested in forests before, and 2. Private actors who have. There is also an important actor, working on behalf of these investors to make it possible, and these are the investment managers. Let’s look at each of these.

Investors new to forest investment

The global climate, nature and circular bioeconomy agenda are bringing the forestry asset class under the spotlight. For the first time, investors who have never considered the asset class before are looking at opportunities, packaged in different ways – timberland, forestry, natural capital, net-zero pathway, decarbonization, nature positive, forest restoration, social forestry – the list goes on for the motivations they might invest. Compared to traditional timberland, this new era of integrating climate and nature objectives attracts new investor profiles. I’ve written about the spectrum of impact investing previously, and where traditional timberland has attracted investors based purely on the merit of the financial characteristics of the asset class, impact investors are increasingly being attracted to it. Furthermore, corporations with net zero ambitions or deforestation-free supply chain commitments are looking for ways to add forests to their balance sheets. Donors, though a smaller pool of capital, also have an important role to play in filling the capital gap in early-stage projects, where the investment/business case are not yet proven.

Investors experienced with forest investment

The other side of the private forest-capital purse, is made up of investors who are already experienced with the asset class. Such investors have three choices when it comes to forest investment: maintain exposure, reduce it, or increase it. And within those options, investors may continue with their existing strategy, or they may change it – for example by integrating climate and nature objectives.

The Role of the Asset Manager

To meet the evolving needs of forest investors, we are starting to witness new natural capital asset management firms emerge. We are also seeing traditional timberland managers offer new climate and nature integrated strategies for their clients, or those aligned to financial regulations like EU Taxonomy alignment or SFDR Article 8 or Article 9 Funds. But this is the output – there are several things that need to happen before a shiny new product will gain the confidence of investors and eventually channel that capital into the ground.

Today’s forest investment managers have some new tasks.

- They need to remain current on carbon markets and emerging biodiversity markets,

- They need to remain current on the shifting landscape for sustainability, climate, nature and ESG regulations, disclosures, and best practices,

- They need to design new investment products that integrate these new climate and nature objectives where track record in achieving them might be absent – and make sure there is deal pipeline to match,

- They need to educate investors on more than traditional timberland fundamentals.

For the asset manager to be able to support new investors to the asset class, and forest investors who are evolving in having objectives for climate and biodiversity, investors need to improve their sustainability leadership.

Sustainability Leadership

I truly believe that to mobilize more capital to forest investments with combined objectives of profitability, climate gains and biodiversity conservation, we need an improvement in sustainability leadership among forest investment managers.

Why?

Investors are transferring their sustainability requirements to the manager. If as a manager, you do not have the capacity to support investor sustainability compliance, they will go elsewhere.

Investors want climate and biodiversity benefits. If as a manager you do not have the expertise or pipeline, to tangibly deliver these (that means having targets, KPIs and a monitoring system to evaluate performance – and the assets to deliver these), they will go elsewhere.

Tough decisions that balance timber, climate, and biodiversity objectives in the investor’s (and forest’s) best interests require sustainability representation in executive leadership. If as a manager, you don’t have sustainability expertise on your investment committee, at the executive or board level – you won’t be able to consider sustainability in your investment or strategic decisions. In short, it will be very difficult to achieve these multiple objectives if the decision makers don’t understand them.

Make the Multiple Objectives of Forestry, Climate and Biodiversity Conservation Realistic to Achieve

The capital need for forests managed for timber, climate and nature objectives is indisputable, especially from private actors. To mobilize more capital to these multiple objectives, we need to educate investors, while innovating new products and being credible sustainability champions at the same time.

If you are an investment manager that wants to provide investors opportunities to achieve profitable forest investments that include climate and biodiversity conservation objectives, please reach out. I help timberland investment managers improve their sustainability credentials to meet the needs of today’s investors.

Did you like this article? Sign up now for the ForestLink’s newsletter, where you’ll receive technical advice, reflections, and best-practice guidance to support you with your forest-linked investment strategy or business straight to your inbox.