I know we’re not supposed to pick favorites, but when it comes to UN organizations, UNEP is one of mine. They get it. The UN Environment Programme gets the importance and leverage of private finance for overcoming global environmental challenges, and have several programs aimed to support the flow of private capital into nature. Recently UNEP released their second annual State of Finance for Nature report. The report has found that

- Finance flows to nature are currently US$154B per year,

- $384B/year are needed by 2025 and $484B/year by 2030 to keep global temperatures below a 1.5°C increase, halt biodiversity loss and achieve land degradation neutrality,

- Private finance makes up only 17% of the current financial flows to Nature-based Solutions (NbS).

In this latest article, I summarize my key takeaways from the report and reflect on the responsibility and opportunity for private forest investment in the tropics. Why not profit while improving the planet?

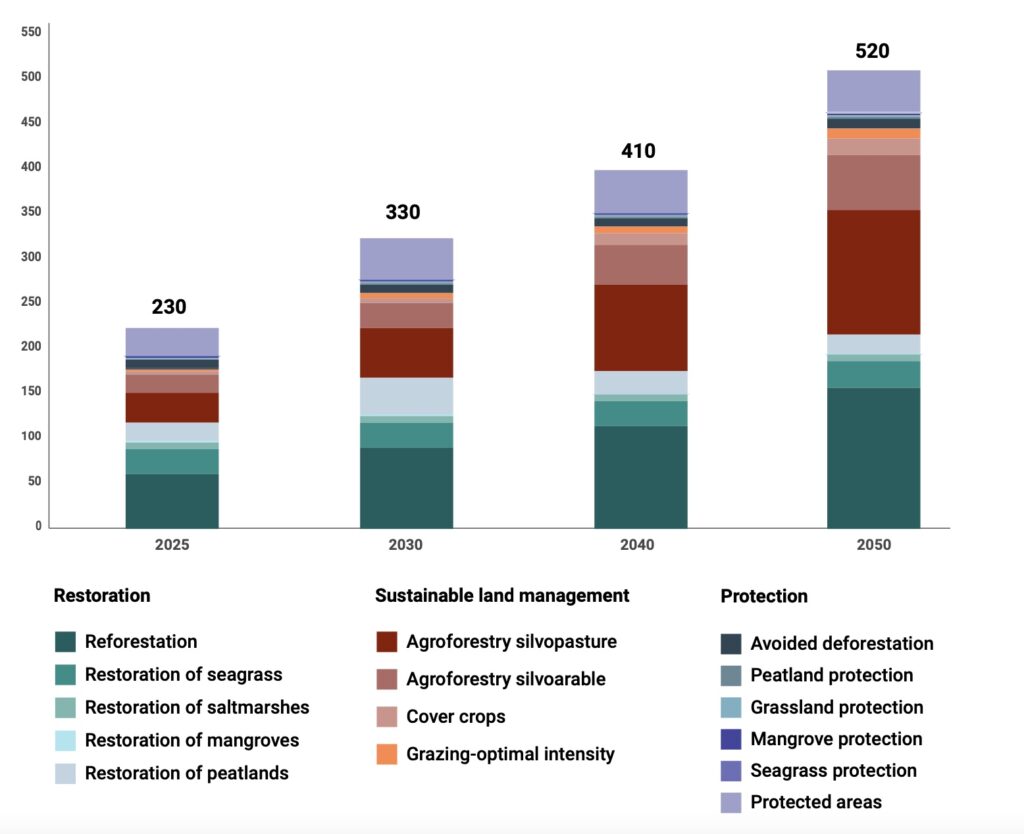

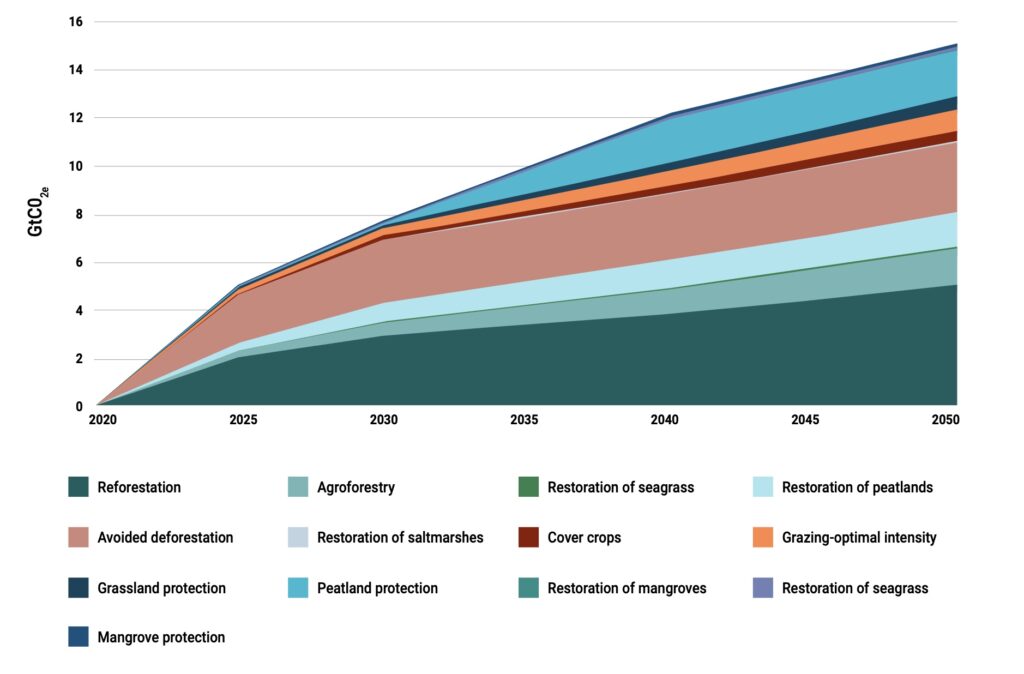

The UNEP report highlights a range of NBS interventions that can deliver climate, biodiversity, and restoration outcomes. The figure below shows in US$, the investment needed across NbS activities that benefit people, climate, biodiversity and/or land restoration. You will note that reforestation is calling for the most capital in the near and long-term. It makes sense when you consider the “bang for buck” that is achieved with this Nature-based Solution. Forests have an unmatched ability in nature to remove significant emissions through their ability to sequester large amounts of carbon at scale, and the cost is relatively low. The second figure, which instead shows the GHG removals (GtCO2) by these same activities emphasizes the point of the emission removal efficiency of forests, with avoided deforestation also high in the ranks. It doesn’t need as much investment however, because quite frankly – the act of protecting a forest is relatively cheap (assuming the cost of safeguards and co-benefit programs are negligible).

Agroforestry is a notably significant NbS requiring investment, with the uncontested need to increase food supply with a rising population – but note that these are agroforestry systems – land-use combining trees and crops.

Figure 3. NbS global GHG removals by activity in 1.5°C scenario, 2022 to 2050, GtCO2

If the earlier mentioned NbS financing gap is closed, and the suggested activities are funded, GHG abatement will be more than 5 GtCO2e per year by 2025, and up to 15 GtCO2e per year by 2050 in the 1.5°C scenario. The expected global annual net emissions are expected to be 25 GtCO2e in 2050, thus NbS can abate 60% of expected GHG by 2050, where reforestation and avoided deforestation represent the lions share.

Key Takeaways for NbS

- To keep the 1.5°C pathway, USD 11 trillion in NbS is needed to 2050, almost 2/3 of this is needed for reforestation (USD 3.4T) and agroforestry (USD 3.6T)

- Finance to NbS is currently US$154 billion per year, less than half of the US$384 billion per year investment in NbS needed by 2025 and only a third of the investment needed by 2030 (US$484 billion per year) to limit climate change to below 1.5°C, halt biodiversity loss and achieve land degradation neutrality.

- Limiting climate change to below 1.5°C is achievable only if action is immediate.

- Private sector investment in NbS must increase dramatically and quickly from the current US$26 billion per year – only 17 per cent of total NbS investment, where it needs to move to over 50 per cent.

- Actual private investment in NbS is not stacking up to the myriad of “net zero” and “deforestation-free” commitments made by agrifood companies, banks, and investors.

Call to Increase NbS Private Financial Flows

After presenting the numbers, the first recommendation of the report is to increase direct finance flows to NbS. Though largely speaking to public capital sources, the paper does call for these institutions to provide incentives for private sector investment, highlighting the need for governmental support in developing:

- High-integrity nature markets (Voluntary Carbon Markets),

- Market governance and infrastructure (formal wood markets, efficient logistics channels, favorable trade policies),

- Availability of concessional capital to forestry and other NbS to absorb risks in emerging markets,

- Sustainability regulatory requirements for businesses and finance institutions to move beyond conventional land use practices (strong forest governance for responsible land use practices),

The report rightly calls out the private sector to move beyond commitments and into action on their voluntary Net-Zero and Nature-Positive promises. It asks that agriculture finance is directed only into land degradation and deforestation-free supply chains. It highlights the obvious need for attracting institutional investors, high-net-worth individuals, and private equity into NbS through the variety of both innovative and tried-and-tested investment vehicles. It points to the importance of carbon and nature markets to give a cash-flow boost to otherwise unattractive NbS investment models. Though private investment is traditionally cautious about cross-sectoral partnerships, the report highlights the importance of partnering with DFIs, NGOs, the UN, and governments to reduce the risks of these NbS business models.

What the Report didn’t say about Drivers of Low Private Investment

Despite the increase in attractiveness of NbS investments in recent years, the numbers speak for themselves. Private investment in NbS remains too low. However, from my work in NbS investments over the past several years I draw the following complementary conclusions:

- Most private investors don’t want to partner with public entities due to the amount of red-tape and slow pace that these political institutions are burdened with,

- Many investors simply still do not understand the investment case for NbS,

- Risks, Risks, Risks – whether real or perceived, they are all real in the investor’s eyes. Risks over the uncertainty of voluntary carbon markets, risks of chronic and acute climate events on the NbS assets, political risks that the report calls on governments to resolve in their points mentioned above, and so on…,

- Action on corporate Net-zero and Nature-positive commitments is stifled by the disconnect between the people in organizations assessing NbS opportunities, and those in the top corner office making the decisions (I revert to not understanding the investment case),

- Insufficient profitable NbS investment opportunities – the fact remains, that early-stage NbS opportunities remain mostly “donor darlings”, while later stage commercially viable opportunities are few.

What can Private Investors Really do about increasing investment in NBS

Though I don’t disagree with the report’s identified needs to mobilize private investment to NbS, I don’t necessarily think they are all realistic. Public wheelhouses move slowly, and any call for urgent action out of these institutions is unlikely to materialize. So what can you do as a private investor wanting to uphold your fiduciary duty while contributing to nature-positive outcomes? Below I give you some ideas.

Get educated – If you’re sitting on the fence about investing into forests because you don’t understand the asset class, its time to get informed. There are numerous resources available to learn more – from forest investment conferences, to white papers, to contacting investment managers themselves, or hiring independent third parties. There’s no reason to

Participate in Carbon and Nature markets – Despite their uncertainty, Carbon markets are charging ahead. Demand is high and supply is low. The Voluntary Carbon Market (VCM) is driving investment into impactful NbS, where with this capital the commercial case is improved.

Reduce the risks you can control – Every investor accepts risk when they make an investment decision. The same goes for investing into forestry NbS – but many of these can be controlled. Appropriate site/species matching, investing into promising wood markets where there is an expected growth in demand and where logistics infrastructure is efficient, investing with highly qualified teams under good leadership, insurance, and so on…

Invest in deal sourcing – Once project developers or forest businesses know that you are looking to deploy capital, several of these proponents will find you. But to access the lesser-known opportunities, you are going to need to dig deeper. Contact your country’s chamber of commerce in interesting jurisdictions to ask for some guidance in deal sourcing in the region, hire well-connected local people to put on their boots and do some (figurative) digging.

Invest in accelerating – Rather than not meeting your NbS capital deployment objectives because of lack of suitable opportunities that fit your strategy, why not invest a small amount of capital to bring high-potential projects to investment-ready? The power of catalytic capital cannot be overstated in this space. It is urgently needed and can be structured safely to protect your investment.

Capture your impact value – The impact benefits of NbS investments on climate, nature, people, and the circular economy are increasingly being valued. These impact markets are only increasing, and it is better to be prepared for them than waiting until its too late. Having a strong Environmental and Social Management System that both reduces your risk and captures the impact value of your investments can set you up to profit from these so-far mostly intangible benefits.

Advocate for NbS investments – if you are already contentedly investing in the space, please please don’t keep quiet about it. Green-hushing is a real thing. Unless prospective investors better understand the NbS investment case from proven examples, these sub-20% NbS financial flows from the private sector will remain that way.

Reduce Risk and Capture Impact Value so you can invest in NbS

I’m a firm believer in the power of strong and practical systems to reduce risk and capture the impact value from NbS investments to bring them to profitability. We have relied for centuries on financial accounting systems to make investment decisions and evaluate investment performance. As our transactional consumerist economy transitions to one that values intangible benefits – a new accounting system needs to be built. If you’re at this stage in your investment journey, where you need a system to both reduce risk and account for impact value, please reach out – I have some ideas that could help.