‘Net-Zero’ and now, ‘Nature Positive’ investors are not so different than the early prospectors in the Klondike. Joining the hype of anticipated fortune, in a region completely unknown to them, with no understanding of the tools they need to achieve their goals, only knowing the desire of the end outcome – gold. Or, in the case of ‘Net-Zero’ and ‘Nature-Positive’ investors, high-quality forest projects.

Last week I had the honor of speaking at the International Forestry Business Conference. In my presentation I discussed how to redefine the forest investment case to support these prospectors, providing them with knowledge, access to high quality projects and the credibility they need to realize a full spectrum of forest values from their investments. The following article summarizes my presentation.

The Forestry Asset Class in Transition

Today, the forestry asset class is in transition. When I studied to become a forester, we were educated on silvicultural regimes that optimized for an economic rotation. Of course, we learned to balance other forest values and respect forest ecosystem processes, but at the end of the day – management is economically driven. To deliver on the return expectations investors have come to rely on – the industry focuses on few, proven species – where there is a high market demand for the timber, where there is good genetic material available, and where you can grow these trees in optimal climatic and soil conditions. Investors have sought out managers who can deliver on these criteria in low-risk geographies, and because of how long it takes to grow a tree, investors are usually interested in forest assets that are either close to maturity, or already realizing returns from harvest.

Of course, we have sustainability standards and best practices, and in some jurisdictions, good forest governance that ensures responsible forest stewardship, but that is not everywhere (I refer to low-risk geographical preference – where these elements would be strong).

Now let’s look at the next generation investor, whose understanding of forest value is expanding. Net-Zero, or Nature-Positive investors are emerging, and they want something more than just forests grown under an economic rotation. This is where it gets tricky – they want the same cashflow generating opportunities, with stable returns, as traditional forest investors, they too want low-risk geographies. However, the days of monoculture are over. They are looking for carbon certified, mixed species forests. They want additional values from the forest to be realized, protection of high conservation values, biodiversity improvement and positive social impacts. This is hard to find.

Traditional Sustainable Forest Management

For a moment, let’s consider a hypothetical best-in-class forest asset from the current status quo. It’s certified to a forest management standard, it maintains area for conservation, hires local people, restores degraded areas, and produces high value timber.

Digging into the ethos of the management behind this asset, we see some common themes that will be embedded into the strategy, product development and ongoing investment management of this asset.

- ESG is a risk management tool – Managers identify risks, such as fire, social acceptance of project’s operational activities, and corporate governance – and diligently manage these elements so that nothing bad happens, and the asset doesn’t lose value.

- Sustainability is a necessary cost of doing business and it’s the right thing to do – forest management certification – though it might not bring a premium on timber price, is often a requirement of the investor, but it doesn’t add to the bottom line.

- Manage forests for maximum economic return – They’ve seen time and again that solid and reliable investment returns are driven by managing the right species, for the right markets, grown in the right conditions.

- Communication with an economic lens – How do investment managers attract investors to this asset in the first place and report back to them on progress? They show the projections for increasing demand, timber price development over time, the geography, and excellent growing conditions where the asset is situated, and the cashflow model. They explain that the project is certified, and maybe that the project aligns to the UN Sustainable Development Goals. Fast forward to the investment management phase, where reporting is generally based on operational progress against invested capital, of course with an annual financial audit and independent valuation of the asset.

To be clear, this hypothetical asset is not a bad investment. However, there are some quick impact wins hiding here, but the additional value is not being fully captured – and the new investor is left wondering how these values are being managed.

Capturing Additional Value

What does capturing the full value of the forest look like?

- It includes maintaining the sophisticated forest management, described in the previous example, for wood products. However, it also requires you to open your mind to adjust management regimes for multiple end products and revenue streams, such as carbon, resins, biochar and bioenergy, for example.

- It includes managing for biodiversity improvement – which in some places will be the simple activity of supporting natural regeneration, or it may be more active, including restoring with native species. This can result in enhanced carbon revenues from areas not conducive to timber products, give you an edge on the up-and-coming biodiversity market, and provide general forest landscape resilience.

- It includes actively supporting local engagement – providing social license to operate, local economic development, and potential partnerships for wood or agricultural product supply – to expand revenue potential.

So how does this differ from the forest investments that are doing this already, like the previous example?

In my view, it is a strategic decision to manage for these values, a shift in the way you see sustainability – in seeing it as a value driver instead of a cost. Managing for impact means you have targets, when you have targets – you have operational plans and activities, you monitor your progress, you are accountable to report back to your investors, and you verify that these values have been realized.

MRV – Your Tool to Demonstrate Additionality and Safeguard against Green-washing

One of the main differences distinguishing the current status quo sustainable forest investment from one that realizes the full value of the forest starts from having the strategic intent to realize these values. It then should employ active management as well as a monitoring, reporting and verification system.

I’m not saying that responsibly managed forests aren’t generating numerous climate, environmental and social values – what I’m saying is that it is more difficult to claim that these impacts are additional to what would have occurred in the absence of your investment or management system. This is especially the case in jurisdictions with strong forest governance and legislation that requires these outcomes you may be claiming are your value addition.

You can bet that the Net-Zero or Nature-Positive investor is going to be scanning your teaser for your expected carbon impact, your metrics for evaluating biodiversity and social improvement, and will also want to see this in your reporting. This will be a must for them with their own disclosure requirements.

I would go further and urge the appraisers in the audience to build systems for appraising climatic, biodiversity and social value – normally wrapped into “good will”. I know, it’s not easy – the industry needs it, if we are to keep up with evolving demand.

Greenwashing is our industry’s nemesis, and it is especially a concern for Net-Zero investors, so let’s help them out and give them the high-quality projects they need, by going a little above and beyond the status quo, by merely bringing these external benefits into active management.

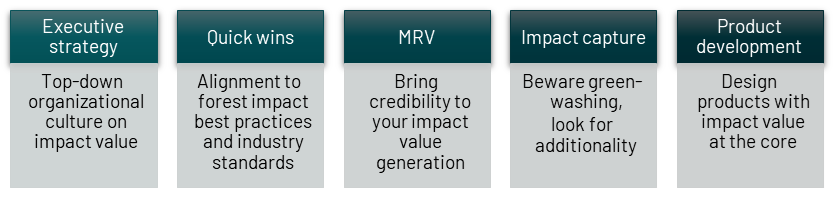

5-Step Process to Re-defining the Forest Investment Case to Attract Net-Zero Investors

In closing, I’d like to summarize how you can redefine your forest investment case to attract Net-Zero or Nature-Positive investors.

- It needs to come from the top – down. Whether you are an asset owner, asset manager, forest manager, or another player in forest investments. The decision to include climate impacts, ecosystem services and social benefits as part of your forest investment case needs to come from the top and become part of the organizational culture. Strategies need to include these impacts as a value driver as opposed to a cost centre. This strategy, must trickle through into your products and offerings, be managed for and communicated. If executive management does not take these steps – it will hold your business back from attracting the next generation of investors and could leave you with a sunset business model.

- Quick wins. If you aren’t already doing so, start with the low-hanging fruit – have publicly facing polices on what you are doing already: sustainable forest management, climate, biodiversity and community engagement policies that are aligned to recognized industry standards such as, various certifications, UNPRI, UN SDGs, TCFD, EU Sustainability Taxonomy and so on. This provides the foundation of knowledge for what is possible in forest investments for the Net-Zero investor.

- Develop your Impact MRV System. Again, regardless of your position in the forest investment sector – you need to rethink how you manage for impact. Just as constructing a sawmill is a necessary investment to realize the financial returns for selling lumber, investing in conservation, native tree restoration, or hiring marginalized workers should be seen as an investment into creating a long-term sustainable, and resilient forest business. Just as you set financial targets, you need to set impact targets, just as you monitor your financial results, you need to monitor your impact results, and just as you have independent auditors and third-party appraisers, you need to have independent verification of your impact – otherwise you put yourself at risk of greenwashing.

- Start capturing impact value in your existing investments. Here is where there is a stark difference in what you can see in the market. There are those that put a fresh coat of paint on the status quo (reporting on some key impact by-products of their business-as-usual practices), and there are those that will capture the eye of the Net-Zero investor, where it is clear that climate, ecosystem services and social improvement are an objective as opposed to an afterthought, or something that is managed as risk.

- Finally, build new products that capture impact. Set targets and attribute value to your impact generation, measure your baseline, make plans for how your impact will be managed, monitored, reported, and verified, and execute on this.

With a progressive re-definition of the investment case, you can position yourself to attract the next wave of investors. This too, will become the next status quo and you don’t want to be left behind.

Need Support in Re-defining your Forest Investment Case?

Are you looking for some quick wins to re-define your forest investment case to become attractive to Net-Zero or Nature-Positive investors? I am increasingly working with these investors and have a deep perspective on they outcomes they are looking for with their forest investment strategies. Please reach out if you’d like to learn more.