I am lucky to work with a number of individuals and organizations that are leading the way in the global bio-economy. These individuals and organisations are taking action to create forest-linked nature-based solutions that are truly sustainable i.e. profitable, good for the planet, and good for people.

However, when looking at an element that silently ties together profit, planet and people, a recent White Paper by the World Economic Forum (WEF) found that amongst the investment community there is an overall lack of guidance about how biodiversity can be best integrated into investment decision-making. This article provides an overview of the white paper, which aims to ‘demystify’ biodiversity practices among the investment community, recommends tools for risk management and ways to leverage investment opportunities in nature-positive business models.

“Profits with purpose and investing in a nature-positive way ought to be the twin bedrocks of all financial transactions.”

WEF, Investing in a biodiversity-integrated manner

The key findings of the report

The report was developed based on discussions between the members of the WEF’s Biodiversity Finance Learning Coalition. It seeks to encourage the investment community to move towards ‘nature-positive’ investing by using pre-existing science-based metrics to quantify biodiversity risk in order to build a ‘future-ready’ portfolio.

The key findings are summarised in the report as follows:

- Asset managers are seeking tangible, quantifiable biodiversity metrics or proxies to reasonably represent investment risks and opportunities. There is little guidance on how biodiversity could be quantified and best integrated into investment decision-making.

- Multiple industry and investor coalitions are working to build science-backed knowledge repositories, market tools and metrics, and reporting frameworks.

- The International Union for Conservation of Nature (IUCN) has criticized efforts to date as “not appropriate for the purpose for which they are being deployed.” Investor practices need to embrace the concepts of societal and ecological thresholds, and how the costs and benefits are allocated across society and generations.

The key recommendations of the report

The report highlights the need for the investment community to mainstream ESG and nature-related issues in order to reach a “common sense approach” to portfolio management and investments. It is not enough to simply rely on “policy nudges” and incremental approaches.

The report, therefore, recommends the following:

- Investors & asset managers could leverage the available biodiversity-inclusive environmental, social and governance (ESG) metrics and scores, along with biodiversity impact measures – accounting for both dependency and impact on nature, which means that biodiversity is part of a wider ecosystem, to build a future-ready portfolio.

- Portfolio analyses through a biodiversity (risk + impact) lens will provide a realistic view of long-term portfolio risks and opportunities.

- Tilting equity portfolios away from “risky” companies will not address the problem. More and better stewardship is necessary, with companies and policy advocacy focussing on governments.

- Innovative real asset (including blended finance) investments for nature-based solutions to climate, ecosystems and biodiversity challenges are a key part of the solution. Asset owners should look to allocate capital in this area while asset managers should look to develop new investment opportunities.

- While gaps remain, there is no time to lose.

Measuring & managing biodiversity impact

Unfortunately, the current corporate reporting of nature-related risks is limited at evaluating risks within the wider ecosystem setting. The report emphasises how ignoring biodiversity and nature related risks is dangerous and the effects will be felt sooner rather than later.

The investment community has a responsibility to use science-based tools which will help to build a strong portfolio and, on a positive note, the report highlights several companies that are using biodiversity measurement approaches to gauge biodiversity risks including AXA Investment Management, Mirova, BNP 10 Paribas Asset Management, Sycomore Asset Management and Pictet Asset Management.

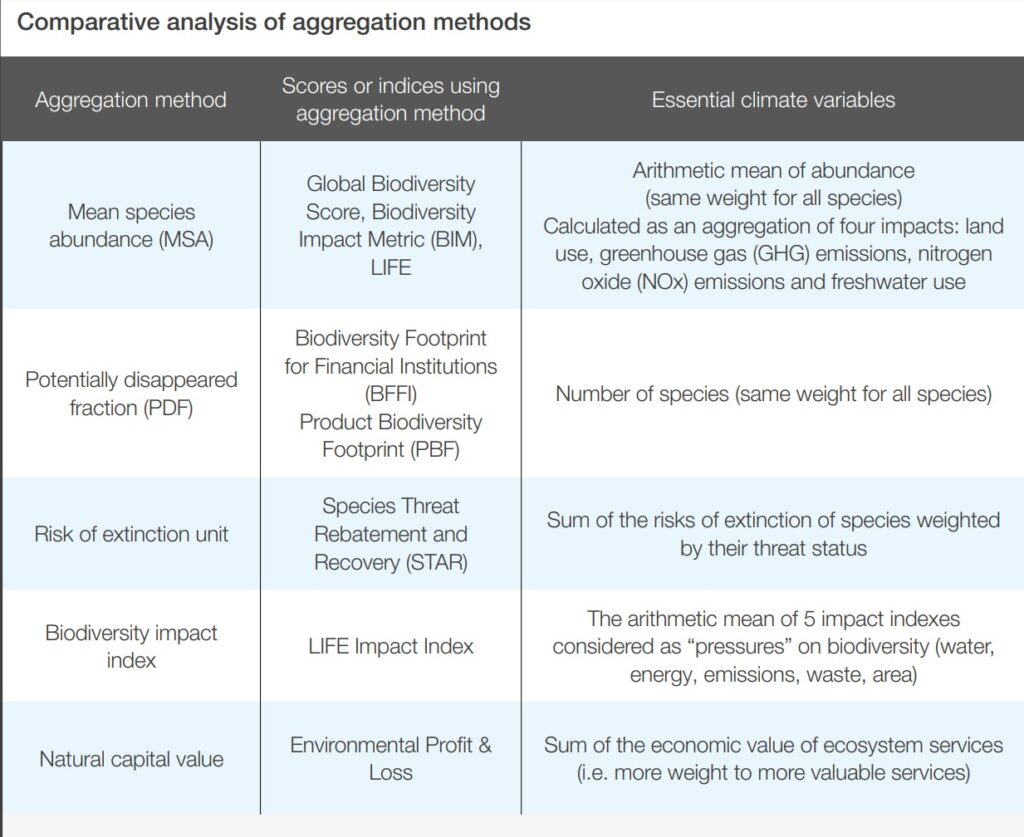

These entities are using measures such as the biodiversity footprint for financial institutions, corporate biodiversity scores & geospatial tools with corresponding aggregation methods. There is, however, limited consensus among both the natural science world and investment practitioners on the effective use of these metrics. Some consider that metrics such as MSA (Mean species abundance) and PDF (Potentially disappeared faction) are not considered appropriate for investment purposes.

The table below is an overview of aggregation methods used by those measurement metrics and tools that are currently popular among investors.

2. Three key sources of characterization factors underpin a number of the methodologies: GLOBIO (Global biodiversity model for policy support), ReCiPe and the International Union for Conservation of Nature (IUCN) Red List.

Source: EU Business & Biodiversity Platform report

List of indicative biodiversity assessment tools & approaches

Widely used tools and metrics used by investors and financial institutions include (but are not limited to the following):

- Mean species abundance (MSA) calculates a company’s biodiversity footprint measured by mean species abundance – the ratio between observed biodiversity and biodiversity in its pristine state. For example, MSA models are being used by CDC Biodiversité (developing the Global Biodiversity Score29) and Iceberg Data Lab to factor biodiversity impact.

- Biodiversity Footprint for Financial Institutions developed by ASN Bank, PRé and CREM is based on the life cycle assessment approach and measures the impact of financial institutions on biodiversity. This has now been developed in to the Partnership for Biodiversity Accounting Financials (PBAF) established by ASN Bank at the end of 2019, together with ACTIAM, Triple Jump, Triodos, Robeco and FMO.

- The GLOBIO model developed by PBL Netherlands Environmental Assessment Agency in collaboration with various aids in quantifying global human impacts on biodiversity and ecosystems.

- Sustainable Investment Framework developed as a software-as-a-service tool by KPMG and Cambridge Institute of Sustainable Leadership for portfolio assessment. One of the areas the framework looks at is resource security that measures the preservation of natural resources through efficient and circular use.

- ENCORE, developed by the Natural Capital Finance Alliance in partnership with UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC), aids financial institutions in assessing portfolio impact on biodiversity in alignment with global biodiversity targets.

- Geospatial tools such as the Integrated Biodiversity Assessment Tool by Global Forest Watch provide a high-level regional environmental impact that might be required to be fitted to the asset level/portfolio level. Some other tools might provide asset or project-level information for integration.

- Net Environmental Contribution developed by Sycomore, Swen Capital and others is used to assess portfolio impact on biodiversity.

- Biodiversity Impact Metric, developed by the Cambridge Institute for Sustainability Leadership (CISL), indicates a business’s impact on biodiversity helping them in managing nature-related supply chain risks. This could be used as a tool by investors in screening and portfolio management.

- Nature Benchmark, developed by the World Benchmarking Alliance, aims to assess the 1,000 most influential companies across 22 industries on their contributions to stable and resilient ecosystems through adequate governance, biodiversity and environmental management while considering social inclusion and community impact.

Biodiversity impact opportunities in forest investment

The forestry asset class presents a host of opportunities for nature-positive investments. From replanting a myriad of species in a mosaic configuration to meet both commercial and native restoration objectives, to protecting intact ecosystems. However, in line with the WEF report’s arguments for science-based measurement – it is not something to be assumed. Too often forest investments assure they are contributing positively to biodiversity, yet their metrics are weak. In order for a forest asset to be able to stand behind its nature-positive claims, it needs to monitor, report and verify the outcomes of interventions to move the asset’s baseline condition forward.

Set-up your Nature-based Solutions Investment Strategy Exploration Call

If you are new to investing in Nature-Based Solutions and you are not sure how to best identify your priorities and how to position yourself for developing a profitable and impactful natural climate solutions investment strategy, I am offering a 2-hour exploration call, to bring clarity to your NBS strategy. I can help you save time and money, so that you can build a targeted pipeline, deploy capital quickly and with the confidence to meet your financial, climate & nature positive investment objectives. If you would like to learn more about this offering, please write to me and I will send you the information. |