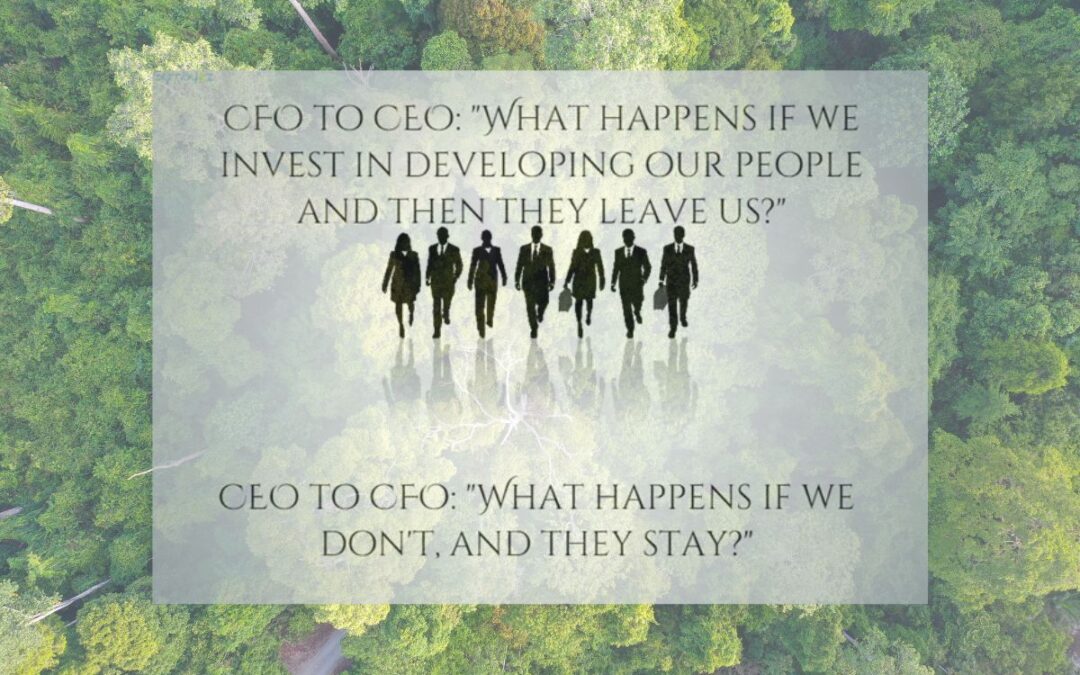

CFO says to CEO “What happens if we invest in our people, and they leave?” CEO says to CFO “What happens if we don’t, and they stay…” Every day for 10 years on my bike ride to and from work, I saw this slogan painted on the window of a leadership development...