…that make the impacts of your forest investment more credible

There are blurred boundaries between sustainable forest management, impact or co-benefit generation and additionality. Often the first two are created without the third element being considered. Though sustainable forest management and impact generation are excellent outcomes for a forest investment, the third piece of additionality is where the tangible value is. Without demonstrating that the impacts generated by your forest investment wouldn’t exist without your intervention, value is being left on the table (carbon credits, payment for other environmental services, expanding your investor universe), and you are opening yourself up to scrutiny from greenwashing. I discussed these elements in my previous article on redefining the forest investment case to attract net-zero investors. Read on to learn the basics about additionality, how it applies to forest investment, and 7 pillars you can use in the design of your forest investment to ensure additionality is achieved.

Defining Additionality

Simply put, Additionality in investing is the positive impact that would not have occurred anyway without the investment (Global Impact Investing Network). When taking to the carbon certification streets, this definition narrows focus, where Verra states in its Voluntary Carbon Standard (VCS), that a project activity is additional if it can be demonstrated that the activity results in emission reductions or removals that are in excess of what would be achieved under a “business as usual” scenario and the activity would not have occurred in the absence of the incentive provided by the carbon markets.

Forest management certification is fairly silent on the concept of additionality. However, forest management certification is more of a management system that has the intent of demonstrating sustainable forest management. It is less interested in whether a certified forest’s management outcomes are additional to the “without project” scenario. That said, I believe that forest management certification also has a role to play in the additionality discussion. For example, achieving forest management certification can be an important KPI if your impact claim is that you are improving forest management practices of an area. It can also be a management tool to support your impact management alongside your forest management.

Additionality in Forest Investment

Sustainable forest investments are inherently impactful. Renewable wood products are created, carbon is sequestered, and climate conditions are regulated, biodiversity is often maintained or improved, jobs are created in rural areas that need them – the list goes on. However, investors are increasingly wanting to know how much of these co-benefits their investments are creating. To take this further, investors are also wanting to know that these benefits would not have happened without their investment i.e. that they are additional. In order to demonstrate this additionality credibly, that investors can defend, a forest investment needs to start thinking about this long before a tree is planted or harvested.

What Additionality is NOT

Additionality is not taking the inherent impacts of sustainable forest investments at face value. Below are some examples of where impact generation and additionality are not the same thing.

Forest management executed in line with forest regulations

If a forest company is simply following the law with their forest management operations, this is not creating additional impact. In other words, in the absence of your project, the same outcomes would be expected from any other party operating in the area. Additionality could be achieved in this example, by going above and beyond forest regulations – but this will need to be demonstrated.

Impact by-products of sustainable forest management

Impact by-products of sustainable forest management can be additional compared to the without project scenario, for example, if the project is not in a jurisdiction with strong forest governance as in many areas in the tropics. However, this is where demonstrating additionality is very important and critical for credibility and meeting investor requirements where claims will be made. Essentially, you still need to prove (measure) how that these co-benefits have been the result of your project.

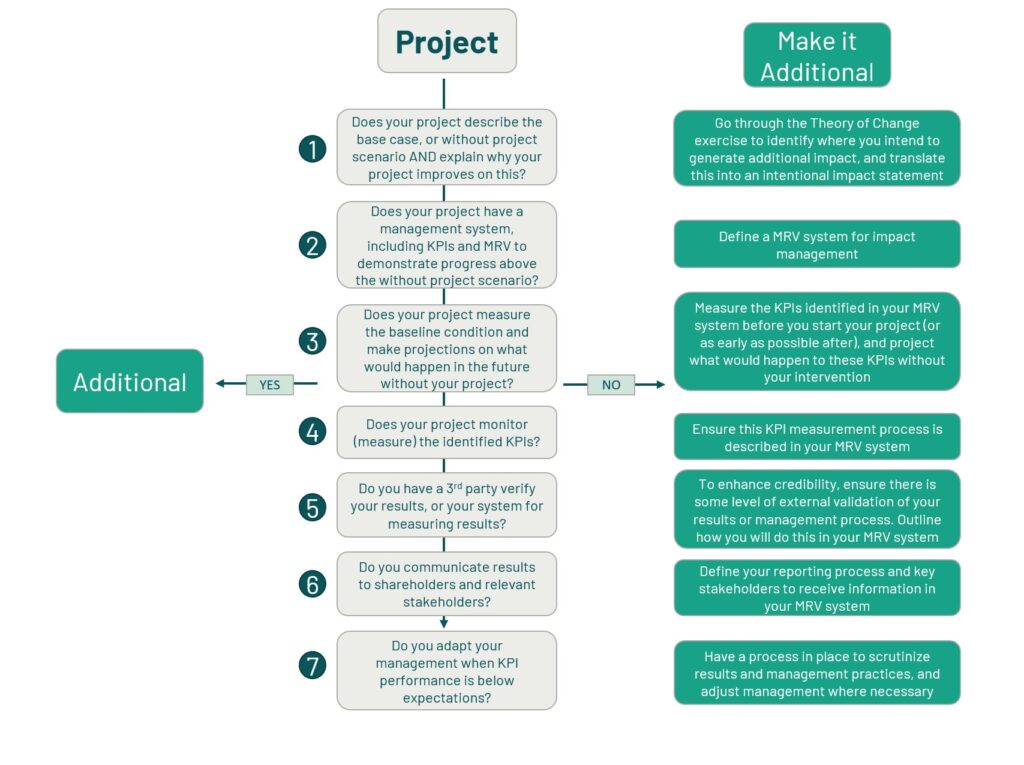

7 Pillars of Additionality

To create a robust and credible impact management framework, Additionality is central to your forest investment. Below I have created a simple key to Additionality, with some tips for how you can demonstrate that the impacts generated from your forest investment are additional. In short, the pillars refer to:

- Statement of intent

- Impact management and MRV system

- Baseline measurement and business-as-usual scenario projections

- Measurement of impact KPIs

- Third party verification

- Reporting to relevant stakeholders

- Adaptive management

You can get a head start on the first pillar by downloading my free Theory of Change Guide for forest impact investments.

Need support in demonstrating that your forest investment co-benefits are additional?

If you are struggling to ensure the impacts of your forest investment are additional, can meet rigorous requirements of impact investors, and withstand the scrutiny of greenwashing critics, please reach out and we can discuss ways to bring additionality to both your existing and future forest assets.