In the tropical geographies I work in, I see a variety of forest carbon strategies being developed by net-zero investors. There are strategies that focus on conservation of existing, rare, and intact forest landscapes. There are strategies that promote the uptake of clean cook stoves and conversion from fire wood to more efficient briquettes. Some strategies focus on the replanting of native tree species on landscapes degraded from various anthropogenic forces, such as shifting subsistence agriculture or commercial deforestation for cash crop commodities. There are some strategies that promote agroforestry cropping systems and livelihood diversification, and some that focus on restoring productive forests with commercial benefits.

In this past article, I discussed the various risks associated with forest carbon projects in the tropics and how to mitigate them. One of the strongest risk mitigation tactics I explained is to incorporate the Produce and Protect model, where carbon sequestration and storage is maximized, while also structuring projects so they are economically viable.

Here, I dig further into the reasoning behind the importance of economic viability in forest carbon strategies. I explain why carbon finance that is not linked to the true drivers of deforestation and forest degradation will not result in long-term climate benefits, and I provide some examples of how to achieve economic viability regardless of your financial objectives as a forest carbon financier.

Why funders of forest carbon projects shy away from economically viable projects

As mentioned in the article on risks associated with forest carbon strategies in the tropics, forest carbon financiers are often opposed to economically linked projects. The reasons are primarily that forest carbon funding does not want to support the optimization of forest crops (or agriculture crops as the case may be) for commercial viability over climate objectives. The fear is of sponsoring vast areas of monoculture, water-demanding species selection, biodiversity loss, poor climate resilience, short rotation lengths, social exploitation, and soil depletion – and of course, the bad press that would go along with it.

However, forest carbon funders afraid of linking their capital to economically viable projects run the risk of not adequately addressing the anthropogenic causes of deforestation and forest degradation, which are economically driven. By financing projects that only exist by way of short-term carbon funding, outcomes will not be sustainable. I believe this is a larger risk, both reputationally and in terms of generating emissions from deforestation and forest degradation that are at risk to resume once the carbon finance runs out.

Addressing the primary drivers of deforestation and forest degradation

By way of example, consider a case in which carbon finance is targeted at a conservation project, where locals, government or other stakeholders are paid in return for carbon credits generated by protecting those forests from emission events (deforestation / forest degradation). How will those people earn their livelihood and finance the protection of their forests after transitionary carbon finance expires? The deforestation and degradation cycle runs a risk of repeating itself.

Instead, forest carbon financiers should look at the economic opportunities behind these drivers of deforestation and forest degradation, and look to replace unsustainable practices with responsible long-term viable business models. Those that will endure long after carbon finance has expired.

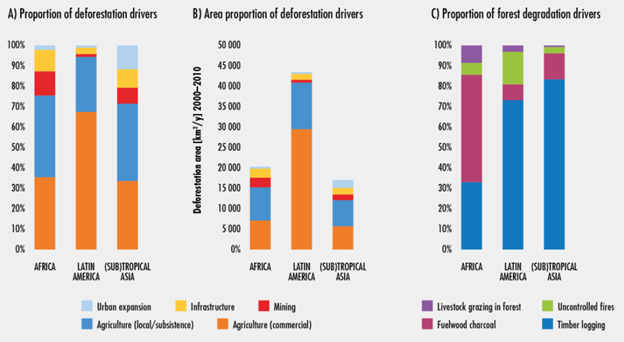

Without getting into the challenge of poor forest governance in the tropics, let’s look at the primary drivers of deforestation and forest degradation that can be flipped into a multiple benefit opportunity. Below I have elaborated on four examples, with the latest FAO data presented in the figure that follows.

Deforestation-linked commodities: The high demand for soy, cattle, palm oil, coffee, and cocoa are examples of commodities that have been produced through clearing forest for its cultivation.

Subsistence agriculture: Though the individual footprint of a small-hold farmer pales in comparison to a palm oil giant, the sheer number of people practicing subsistence agriculture through degrading practices results in a huge risk to forest ecosystems and ultimately the people depending on them.

Fuel wood and charcoal production: An estimated 880 million people spend part of their time collecting fuelwood or producing charcoal (FAO, 2020) to fulfil their energy needs and generate income.

Illegal logging: In addition to the emissions from deforestation, illegal logging results in several additional challenges, like biodiversity loss, soil erosion and declined hydrologic cycle integrity, social inequality, poor health and safety, and absence of taxes being paid to governments. Yet, there are few viable alternatives currently to meet rapidly rising wood demand.

Let’s flip it – Options for integrating economic viability

There is a spectrum of economic viability. On the one hand, there are large commercial forest and agriculture companies – where cooperation with them has the benefits of scale, efficiency, and long-term viability built in. On the other hand, there is economic viability in more subsistence, or income generating activities – where cooperation with smallholders has the benefits of multiple co-benefits and addressing land tenure challenges where tenure security is a concern. The first two examples below highlight opportunities within company engagement, while the last two examples represent smallholder engagement.

1. Commercial reforestation

There is a reason that illegal logging exists. There is an unmet demand for wood products. Commercial reforestation should be a preferred alternative to forest carbon strategies looking to restore degraded forest ecosystems. Here there is an opportunity to substitute unsustainable and inequitable practices with a more responsible approach. Regardless of where you stand on your own organization’s commercial objectives, the long-term viability of your forest carbon investment, after carbon funds have expired, depends on it. How the project is designed can take many shapes and is not dependent on the vast monoculture exotic plantations that forest carbon investors are afraid of. It can include the growing of local commercial species, mixing exotic commercial species with native non-commercial species and many various iterations, including climate change adaptation co-benefit programs with local people, and conservation elements.

2. Joint venture with commercial agriculture

I see significant opportunity for a forest carbon financier to join forces with commercial agriculture businesses. Often agriculture businesses have tenure rights (either owned or leased) to more land than they can cultivate. It may be unproductive for the purpose of growing their particular crop, or it might be otherwise challenging in terms of topography, or logistical access – making it commercially unviable. In these instances, partnering with such a company, where your funds could be used on uncultivated lands to either restore natural forest ecosystems or protect ones that are intact could present an optimal partnership.

3. Agroforestry

Agroforestry is seen as a land-use approach that can meet several objectives – from food security through sustainable wood supply, climate resilience, livelihood diversification and biodiversity improvement. However, compared to its isolated counterparts, of conventional agriculture or commercial forestry, agroforestry can present economies of scale practicalities to consider. In many tropical geographies, where land tenure is dominated by subsistence small-holders it is very applicable. For a company considering a forest carbon strategy in geographies with an abundance of small-holders, supporting the transition to climate-smart agroforestry land-use systems is an appropriate intervention. Appropriately designed systems can provide for both subsistence needs, but also generate livelihood diversification through the growing of timber trees, agricultural crops for sale and the spurring of other small businesses. Due to the dominance of the small-holder in such strategies, investing into the cultivation and its training, as well as education around financial literacy is important.

4. Woodlots

Reforestation via the establishment of community, cooperative, or small-hold farmer woodlots can provide timber income, fodder for livestock, and fuelwood. Woodlots present an alternative for forest dwellers that would normally be involved in illegal logging activities or continuous degradation of natural forests for subsistence needs. They often can be incorporated into agroforestry systems (see previous example). Woodlot systems that also incorporate assisted regeneration of native tree species can support conservation and biodiversity objectives at the same time as providing livelihood options. An addition to strategies that support sustainable fuel wood, would be to consider the production of more efficient briquettes or sustainable charcoal and the uptake of using clean cookstoves.

A fully integrated, approach with multiple economic opportunities should be your target

If you are a forest carbon financier with sufficient capital at hand, your best option is to target interventions that both increase the carbon sequestered and stored from your activities, but also address multiple drivers of deforestation and forest degradation through economically viable interventions. This landscape approach will best optimize land-use, have numerous co-benefits, and reduce overall risk through market diversification. The best way to utilize your forest carbon funds is in nature-based solutions that truly address deforestation and forest degradation – economic interests. And the best way to tackle damaging practices is to flip them into more sustainable ones.

If you need support in designing a forest carbon strategy in the tropics that gets to the root cause of deforestation and forest degradation, please reach out.